About

Credits Delivered

Clients Served

Retention Rate

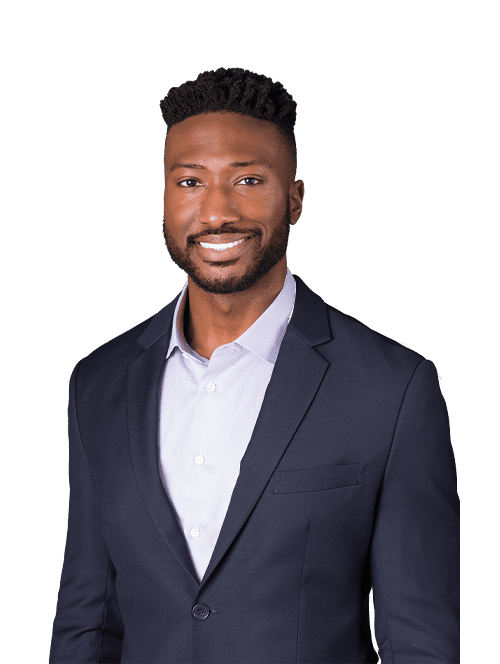

Uche Okoroha

Uche is a licensed attorney with expertise in tax law and IT consulting.

Uche has spent the entirety of his career focusing on complex legal issues affecting the design industry, with the majority of his time dedicated to the R&D tax credit. Prior to founding TaxRobot, Uche served as a Senior Project Manager at a national tax consulting firm. Subsequently, Uche founded Parachor Consulting, which has impacted the long-term success of hundreds of organizations by delivering substantial tax credits that allow businesses to reinvest in their growth.

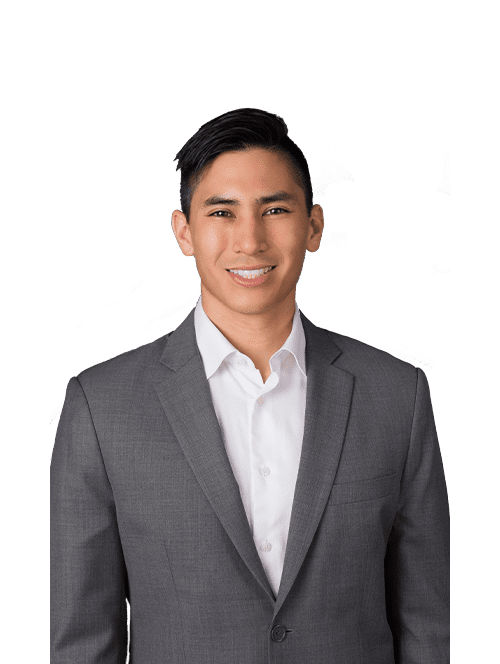

Chris Sioco

Chris is an engineer turned tax consultant.

Chris is focused on helping small to mid-sized businesses claim the R&D tax credit. He was formerly a consultant with one of the largest tax credit firms in the nation, and a founder of Parachor Consulting, a successful R&D tax advisory firm. By utilizing his engineering background, he is able to more closely relate to the needs of his clients and understand the technical work they are performing, which is critical in performing R&D tax credit analyses.