Filing tax forms as a business owner is a complicated, tedious, but essential part of operating successfully within the working world, especially if you’re filing with the hope of receiving decent tax returns or credits. Sadly, due to the complicated nature of filling out and filing many tax forms, it’s common for tax documentation to include a few mistakes.

Thankfully, there are ways for people to correct errors on their tax documents to have the best possible chance of receiving the returns and tax credits their businesses are due.

Below, our team of professional tax experts from TaxRobot will delve into the basics that business owners should understand about IRS Form 941 and how they can amend errors on the Form to receive their needed tax credits, primarily the ERC. Please continue reading on to learn more, and also consider looking through our website to learn about us and our range of specialized tax services.

Related: Business Startup Costs & Tax Deductions

Table of Contents

The Employee Retention Credit and Form 941: Basics to Note

Before we talk about how to amend errors on Form 941 for the sake of your ERC, let’s take a moment to explain what both are. In short, IRS Form 941, or the Employer’s Quarterly Federal Tax Return, is a quarterly tax document employers must fill out and file with the government to report FICA taxes withheld from employee salaries. These include federal income tax, Medicare tax, and social security tax.

The Employee Retention Credit (ERC) is a quarterly tax credit that can be applied against an employer’s share of certain payroll taxes throughout 2021, thanks to the extensions passed into Legislation in December 2020 and March 2021 as part of the America Rescue Plan Act (ARPA). Business owners can apply for this tax credit using specific line items in Form 941.

What to Do About Form 941 Errors

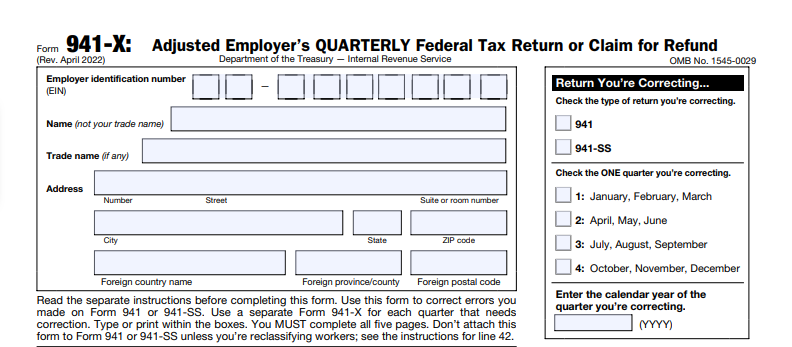

Suppose you include inaccurate or incomplete information on IRS Form 941. In that case, you’ll need to correct your mistakes by filling out and submitting Form 941-X, also called the Adjusted Employer’s Quarterly Tax Return or Claim for Refund.

When looking at Form 941 and Form 941-X side by side, you’ll notice that the latter is essentially a copy of the original Form but includes areas where you can make amendments to incorrect information provided on the initial Form. The IRS designed the series of “X” forms (including Form 941-X) to make it easier for business owners to correct their tax forms.

Related: Startup Consulting: Is it Worth It in 2022?

What Does Form 941-X include?

Like Form 941, Form 941-X has five parts, but they are slightly different from the initial 941 Form.

- Part 1: Asks if the Form is being filed for a claim or an adjusted return (both can be chosen)

- Part 2: Asks about why the Form is being filed and whether you’re seeking a claim or refund adjustment

- Part 3: Asks you to include a copy of your original Form 941 and asks you to explain which sections were done incorrectly

- Part 4: Asks for an explanation of why the corrections are needed

- Part 5: Requires your signature (and the signature of a paid preparer if one is involved)

Learn about how TaxRobot can help automate your R&D tax credit today!

What Information Does Form 941-X Let Employers Correct?

In the event of inaccurate information, missing information, or other issues related to a submitted IRS Form 941, employers can use Form 941-X to correct;

- Taxable social security wages (and tips)

- Taxable Medicare wages (and tips)

- Taxable wages and tips subject to additional tax withholding for Medicare

- Wages, tips, and other forms of compensation, along with income tax withheld from these types of payments

- Credits for COBRA premium assistance

The IRS currently defines two types of errors that can occur with Form 941. Depending on the kind of error you’re dealing with in your Form 941, there are different requirements for when you can correct them.

The first is administrative errors, or mistakes of transposition, which refer to mixing up numbers or mathematical errors that cause inaccurate reporting of an amount withheld. Administrative errors can be corrected at any time using Form 941-X unless it causes an under or overreported tax.

The second type of error involved with Form 941 is federal withholding errors, which typically refer to inaccurate information regarding what amount was withheld from employee paychecks. Employers can only use Form 941-X to correct federal withholding errors in the same year that the wages were paid. Additionally, federal income tax withholding can only be corrected if employers are reimbursed or repaid.

Related: R&D Credits & AMT: Here’s What to Know

When and How Should You Submit Form 941-X?

The due date to submit Form 941-X depends on when you discovered the error in your Form 941 and whether you under or overreported your tax information. In the case of over-reported tax, you can make an interest-free adjustment and a future quarterly 941 Form or file a claim for an abatement or refund using IRS Form 843. If you underreported your taxes, you must file Form 941-X and pay the required amount due by the due date included on the original Form 941 after discovering the error.

Once filled out, you can mail your Form 941-X to the address on this list that correlates to the location of your business’s address.

Final Factors to Keep in Mind

Our team of passionate tax professionals at TaxRobot hopes that you’ll be able to leverage the above resource if you ever need to make any amendments to your IRS Form 941 submission. We always encourage you to double and triple-check the information you provide on all tax documents to help ensure you don’t encounter any problems or penalties with the IRS, especially regarding your returns or needed tax credits.

For access to more great information, please consider browsing our vast collection of other expertly written tax and business resources, which cover an assortment of critical topics, from product development to federal government loans for small businesses and startups.

Need help with your business’s taxes this year? TaxRobot is here to lend a hand!