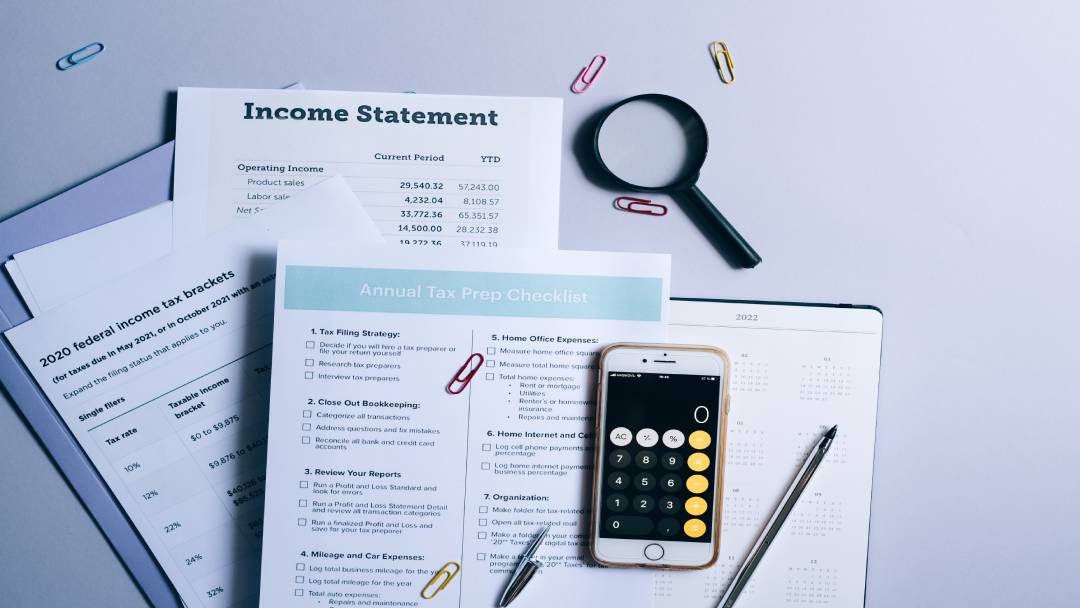

Handling your taxes is difficult and can lead to errors if you are not careful. That is why around 46% of Americans use tax software to file their taxes for them. The convenience, accuracy, and professional help provided by services like these are essential to many.

However, not all tax preparation services are built the same. That is why we’ve prepared a list of the best tax preparation services to use in 2024. Let’s take a look.

Related: How Startup Technology Companies Qualify For the R&D Tax Credit

Table of Contents

Best Online Tax Preparation: TurboTax by Intuit

TurboTax by Intuit is the top choice if you’re looking for overall tax preparation online. Their online tax software offers many features and benefits yet is easy to use.

This is because their software takes you through the process in a step-by-step approach. It asks simple and straightforward questions that it then uses to fill out complicated forms. It simplifies things on your end so that the files can still be as complex as they need to be while you don’t need to worry about figuring it all out.

On top of all of this, TurboTax offers great support. This helps on the off-chance that you are confused by the system or if you just want to ask additional questions.

Best In-Person Tax Preparation: H&R Block

The services offered by H&R Block are pretty similar to those offered by TurboTax. Like TurboTax, H&R Block offers online software that makes filing your taxes easier. However, TurboTax’s program is slightly easier to use, which is why we chose it as the “Best Online Tax Preparation” service for this list.

Where H&R Block sets itself apart is through its in-person services. H&R Block has thousands of physical offices across the country. With such a large number of offices out there, chances are that at least one is near you.

This has a unique appeal that many people are sure to appreciate. With work-from-home becoming more common and online shopping dramatically growing in popularity, it is becoming less and less common for businesses to run physical locations. For anyone that prefers to handle important work in person, H&R Block has an edge.

Want to make sure you get the biggest tax refund you can? See how our R&D tax credit software can make it easy!

Best Cheap Tax Preparation: Jackson Hewitt

Jackson Hewitt is another comprehensive tax preparation service. However, they don’t shine quite as bright in many areas as their competitors. Specifically, their online program isn’t as easy to use and doesn’t offer as much as the ones from TurboTax and H&R Block. It is still accurate and is alright to use, but it isn’t quite as nice.

Where Jackson Hewitt stands out is the price. They offer free consultations, so you can get started with them worry-free. After this, they offer a competitive price for their services that rivals the competition. Jackson Hewitt is a good choice for someone on a budget looking for an all-around option.

Best Free Tax Preparation: Cash App Taxes

While you may not have known that Cash App offers a tax preparation program, it isn’t a new service. Cash App acquired Credit Karma in 2020 and, after doing so, integrated Credit Karma’s services into its system.

Cash App offers free tax preparation for people in certain situations. Specifically, it offers its free services to people with a generally straightforward and typical tax situation. As this is the vast majority of people, a service like this is seriously helpful.

The biggest problem here is that Cash App Taxes only works in specific and uncomplicated situations. It doesn’t work at all if you’re filing taxes for a business. In addition, people filing in multiple states, people with foreign incomes, and people in some other situations cannot file their taxes with Cash App.

Related: Business Startup Costs & Tax Deductions

Best For the R&D Tax Credit: Tax Robot

While the tax services listed above are great if you’re just looking to file your taxes in an uncomplicated way, they aren’t the best when it comes to tax credits. Other services often miss credits that should be available to you and, thus, prevent you from getting the tax refund you deserve. This is especially true if you have a business.

Tax Robot specializes in the R&D tax credit. We are well-versed in dealing with this credit and have a proven track record of getting it for our clients.

This starts with our R&D tax credit consulting. We’ll look at your company to determine if you are eligible for this tax credit. This is a simple consultation that has no downside for you and simply offers the potential to save your company money. The lack of downside comes from the fact that we don’t charge anything unless we find a benefit. So, it is all positives and no negatives!

Then, we can help ensure you get this credit. We have comprehensive R&D tax credit software that turns a complex process into only three steps. This allows you to save a lot of time and energy that you would otherwise have to dedicate to this. Even though our software simplifies things for you, it doesn’t compromise quality. This results in an accurate and worry-free process.

Sometimes you need a little extra attention when it comes to making sure your taxes are done right. Talk to an expert at TaxRobot and see how we can help you get the most out of your return!

Best for Complicated Situations: EY TaxChat

Not everyone has a straightforward tax situation. In particular, people who work remotely or who are self-employed have unique situations that often require more attention.

People working in one state but living in another will often need to file taxes in both locations. This opens up the potential for problems and opportunities for missed tax credits. Meanwhile, self-employed people, whether through a sole proprietorship or something else, have to pay self-employment tax.

EY TaxChat helps with these unique situations. With them, you talk to a human and explain the unique nature of your situation. Then, they help walk you through what you need to do. In this way, EY TaxChat offers some seriously good customer service and provides help no matter what kind of situation you find yourself in.

The Best Tax Preparation Services in 2024

There are a lot of tax preparation services out there, and each one offers something different. Make sure to consider your options to find the best one for you. Once you have done so, you can start working toward getting your taxes in order.