As an employer within the United States, you are legally obligated to file a wide range of essential tax paperwork at different points throughout the year. With so much tax filing to stay on top of, our experts at TaxRobot understand how confusing and frustrating it can be to ensure everything is filed correctly and at the right time.

In the article below, we’ll help make the process easier by exploring the basics you need to understand about IRS Form 943 and providing instructions on how to correctly fill out the document to avoid any errors or issues with the Internal Revenue Service.

Please continue reading for more information, and also consider making an account with us and exploring our website to learn about our wide range of excellent AI-powered tax services.

Related: How Startup Technology Companies Qualify for the R&D Tax Credit

Table of Contents

What is IRS Form 943?

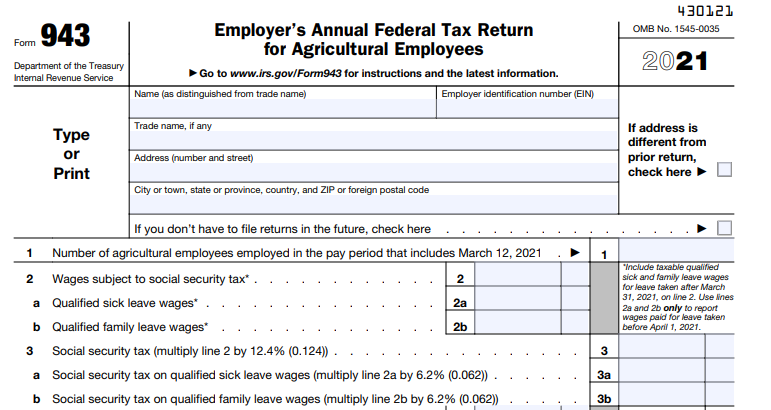

The Employer’s Annual Federal Tax Return for Agricultural Employees, or IRS Form 943, is a tax document filed by any employer who paid wages to one or more farm workers during the year. However, said wages must be subject to federal income tax withholding, Medicare, or social security taxes. The Form is designed to be used in place of- or sometimes in addition to- Form 941, which business employers leverage to file their quarterly federal tax information.

Any employer who pays a farmworker employee at least $150 during the calendar year or who paid at least $2,500 in total cash and non-cash wages (food or lodging) during the previous calendar year must file IRS Form 943.

You can download a free, blank copy of the 2021 version of Form 943 here to fill out online or print and fill it out by hand.

Basic Information For Filling Out and Filing Form 943

Like any other type of tax document, there are detailed and specific instructions people need to follow to ensure that they are filling out their tax forms as accurately as possible to avoid a range of potential issues and penalties from the IRS. You can download a free version of the 2021 Form 943 Instructions here, but the document is highly technical, 30 pages long, and can be difficult for many people to understand fully.

To help make the filing process as straightforward as possible, we’ve pulled out the essential instructions you need to follow when filling out your annual 943 tax Form in the sections below.

Related: How to Calculate CAC in 3 Easy Steps

The Information You’ll Need For Form 943

To correctly fill out IRS Form 943, you’ll need;

- A printable Form 943 (or one you can fill out on your computer)

- Your EIN and other essential information

- The number of farmworkers you paid throughout the calendar year

- The amount in cash wages paid

- The total federal income tax withheld from all employee wages

- Total of the employee’s portion of Medicare and social security taxes withheld from wages

- Total of the employer’s portion of Medicare and social security withheld

- Any additional Medicare taxes withheld from wages

- The year’s adjustment to Medicare and social security for tips, sick pay, group-term life insurance, and fractions of cents

TaxRobot is here to help your business succeed, so learn about our services today!

IRS Form 943 Instructions

Like many tax forms, Form 943 requires you to include various Information and calculations on different lines within the document. Going line by line, here are the steps you need to follow:

Line 1: Put down your total number of employees paid during the pay period included in the document.

Line 2: Put down the total wages subject to social security tax (up to $137,700 for any individual employee).

Line 3: Calculate the social security tax owed by multiplying Line 2 by 12.4% and enter the total on this line.

Line 4: Put down the total wages subject to Medicare tax (there is no upper limit for this amount).

Line 5: Calculate the Medicare tax owed by multiplying Line 4 by 2.9% and enter the total on this line.

Line 6: If any farmworker was paid more than $200,000 during the year, you’ll need to withhold additional Medicare tax. Enter the total wages subject to the additional tax in this box.

Line 7: Calculate the additional Medicare tax by multiplying Line 6 by 0.9% and enter the total on this line.

Line 8: Put down the amount of federal income tax withheld from employee wages.

Line 9: Put down your total taxes before adjustment by adding the values of Line 3, Line 5, Line 7, and Line 8.

Line 10: Include any tax adjustments on this line, including those that apply to;

- Rounding fractions of cents

- Adjustments for sick pay

- Uncollected employee shares of Medicare and social security taxes on group-term life insurance premiums and sick pay

Line 11: Put down the total taxes after adjustment by adding the totals from Line 9 and Line 10.

Line 12: Enter the amount of any tax credit your business qualifies for on this line. Note, you’ll need to fill out Form 8974 to determine the tax credit your business qualifies for and attach it to Form 943 before submission.

Line 13: Put down the total taxes after any credits or adjustments by subtracting Line 12 from Line 11.

Line 14: Put down any deposits made during the year, including any overpayments.

Line 15: If your value for Line 13 is more than Line 14, enter your balance due here.

Line 16: If your value for Line 14 is more than Line 13, enter the difference here and select whether you’d like a refund sent to you or want the overpayment applied to your next tax return.

Ensure that all of the above information is correctly included on the document, and file it by January 31.

Related: Understanding Convertible Debt

Final Factors to Keep in Mind

Our team of dedicated tax professionals at TaxRobot sincerely hopes that the above resource will help you tackle your future filing efforts for IRS Form 943 without encountering any issues. To access more information on critical tax documents, please consider exploring our wide assortment of other great educational resources.

Our experts have painstakingly compiled these helpful documents to help teach dedicated business owners everything they need to know on critical business topics, including R&D tax credits and qualified research expenses.

Are you looking for bigger, better tax refunds? TaxRobot can help your business get them!