Get up to $26,000 per employee for simply keeping them on your payroll

The Employee Retention Tax Credit is one of the most powerful tax credits ever. This benefit is fully refundable – meaning the IRS will cut you a check even if you paid less in taxes than your tax credit.

- Free Consultation

- Quick Setup

- Rapid Results

Trusted By:

Jinesh Patel

As a former R&D tax credit consultant myself, I see tremendous value in TaxRobot. They are fast, accurate, efficient, and have true experts supporting you through the process. I highly recommend them to anyone considering an R&D Tax Credit software to complete their analysis.

Why choose TaxRobot

for ERTC calculations?

TaxRobot takes the guess work out of claiming tax credits by automating the process with technology. It is now possible to maximize your ERTC tax credit and create audit-proof documentation in a fraction of the time that it takes with a traditional tax credit study. The founders of TaxRobot are true subject matter experts with extensive experience calculating, substantiating, and defending the ERTC tax credit.

- Maximize your benefit

- Reduce audit risk

- Free audit defense

- Straightforward process

We make the ERTC tax credit simple.

A Message from our Founders

With TaxRobot, we have taken our 15+ years of experience in tax consulting and used it to create the most comprehensive tax credit software on the market. Working for large consulting firms helped us learn the best processes, but also showed us there’s often a lot left on the table when it comes to tax credit calculations. Our software provides the same expertise of large firms, while eliminating human error. The best part is that in addition to a robust tax credit software, you will always have access to industry experts who support the calculation.

Using TaxRobot

- Quick and Easy Process

- Comprehensive Documentation

- Value-Based Pricing

- Audit Defense

- Maximum Credit Calculations

Using tax credit consultants

- Complicated & Time Consuming

- Little to No Documentation

- Expensive

- Audit “Support”

- Money Left on the Table

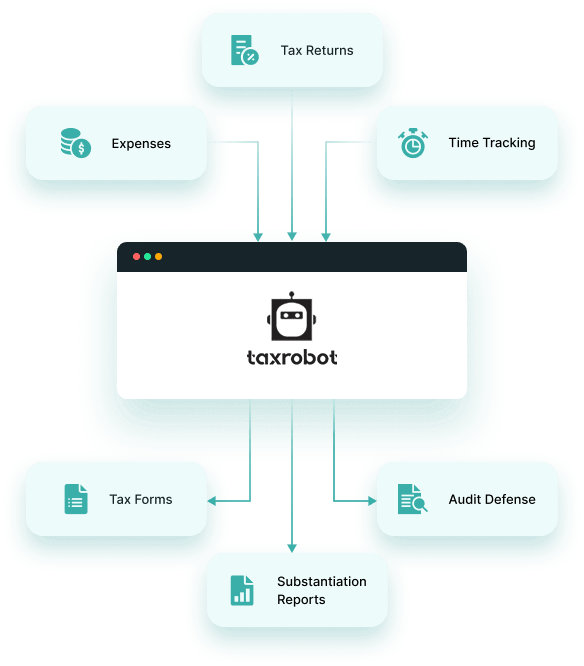

How it Works

We take our comprehensive ERTC tax credit process developed by subject matter experts and reduces it to three simple steps. You can now complete your tax credit claim in half the time without sacrificing the quality of the analysis and the reporting that supports it.

Provide Your Information

Link Your Systems

Receive Your Refund

Employee Retention

Tax Credit FAQs

1. Your trade or business was fully or partially suspended or had to reduce business hours due to a government order. The credit applies for the portion of the quarter the business is suspended, not the entire quarter.

2. Your trade or business had a significant decline in gross receipts.

2020: if gross receipts in a calendar quarter are below 50% of gross receipts when compared to the same calendar quarter in 2019, your business will qualify.

2021: if gross receipts in a calendar quarter are below 20% of gross receipts when compared to the same calendar quarter in 2019, your business will qualify.

3. Recovery Startup Business: if your business started after February 15th, 2020, had annual gross receipts that are less than $1 million

The wages of any majority owner (greater than 50% ownership) do not qualify for the ERTC. Additionally, any related individual’s wages with the following relationships do not qualify for the ERTC:

- A child or a descendant of a child.

- A brother, sister, stepbrother, or stepsister.

- The father or mother, or an ancestor of either.

- A stepfather or stepmother.

- A niece or nephew.

- An aunt or uncle.

- A son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or

sister-in-law. - An individual (other than a spouse, determined without regard to section 7703 ,

of the taxpayer) who, for the taxable year of the taxpayer, has the same

principal place of abode as the taxpayer and is a member of the taxpayer’s

household.