Expert Consultants for Your R&D Tax Needs

Don’t miss out on valuable R&D tax credits and incentives. Partner with us and let our expertise work for you.

- Free Consultation

- Quick Setup

- Rapid Results

Trusted By:

Jinesh Patel

As a former R&D tax credit consultant myself, I see tremendous value in TaxRobot. They are fast, accurate, efficient, and have true experts supporting you through the process. I highly recommend them to anyone considering an R&D Tax Credit software to complete their analysis.

Why choose TaxRobot

for R&D tax credit calculations?

TaxRobot takes the guess work out of claiming tax credits by automating the process with technology. It is now possible to maximize your R&D tax credit and create audit-proof documentation in a fraction of the time that it takes with a traditional tax credit study. The founders of TaxRobot are true subject matter experts with extensive experience calculating, substantiating, and defending the R&D tax credit.

- Maximize your benefit

- Reduce audit risk

- Free audit defense

- Straightforward process

Unlock the Secrets of the R&D Tax Credit.

Enter your email below for our Free R&D Playbook,

A Message from our Founders

With TaxRobot, we have taken our 15+ years of experience in tax consulting and used it to create the most comprehensive tax credit software on the market. Working for large consulting firms helped us learn the best processes, but also showed us there’s often a lot left on the table when it comes to tax credit calculations. Our software provides the same expertise of large firms, while eliminating human error. The best part is that in addition to a robust tax credit software, you will always have access to industry experts who support the calculation.

Using TaxRobot

- Quick and Easy Process

- Comprehensive Documentation

- Value-Based Pricing

- Audit Defense

- Maximum Credit Calculations

Using other tax credit consultants

- Complicated & Time Consuming

- Little to No Documentation

- Expensive

- Audit “Support”

- Money Left on the Table

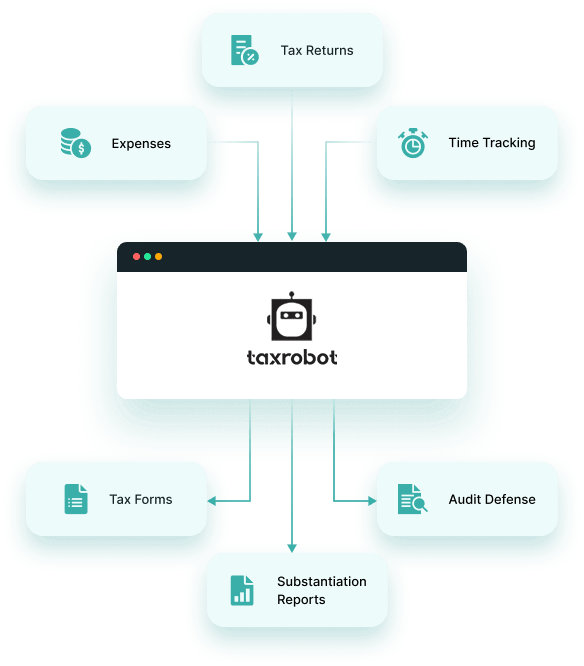

How it Works

Provide Your Information

Link Your Systems

Receive Your Refund

What can the R&D tax credit do for your business?

R&D tax credits can provide a significant reduction in a business’s tax liability, freeing up more resources for growth and investment.

By incentivizing innovation and experimentation, R&D tax credits can encourage businesses to develop new products, services, and processes that can improve their competitiveness and profitability.

R&D tax credits can also help businesses to attract and retain top talent by demonstrating a commitment to innovation and investment in research and development.

What Industries Quality For R&D Tax Credit ?

The eligibility of a business for R&D tax credits depends on a variety of factors, such as the nature of the research activities, the types of expenses incurred, and the documentation and record-keeping requirements. It is always recommended to consult with a tax professional or R&D tax credit specialist to determine if your business qualifies.

Software and technology

Pharmaceutical and life sciences

Manufacturing

Aerospace and defense Four

Architecture and engineering

Energy and utilities

Food and beverage

Agriculture and farming

Why Should You Hire an R&D Tax Incentive Consultant?

- Expert Knowledge and Experience: R&D tax incentive consultants have specialized knowledge about R&D tax credits and incentives, including eligibility criteria, application processes, and compliance requirements. Their expertise can help ensure that your business maximizes its claim while adhering to the complex regulations and guidelines set by tax authorities.

- Maximizing Your Claim: An experienced consultant can identify qualifying R&D activities and expenditures that you may not have considered, ensuring that you claim the maximum amount possible. This can significantly boost your company’s financial return from R&D investments.

- Compliance and Documentation: Proper documentation and compliance are critical in R&D tax incentive claims. Consultants can help you maintain appropriate records, prepare necessary documentation, and structure your R&D projects to meet the specific requirements of the tax incentive program, reducing the risk of errors or omissions that could lead to audits or disputes.

- Time and Resource Efficiency: Preparing and managing R&D tax incentive claims can be time-consuming. By outsourcing this task to a consultant, your team can focus on core business activities and R&D projects, rather than navigating the complexities of tax incentive claims.

- Audit Support: In case of an audit by tax authorities, having a consultant who is familiar with your R&D claim and the intricacies of the law can be invaluable. They can provide expert representation and support throughout the audit process, helping to defend your claim and address any issues that arise.

- Staying Updated with Changes: Tax laws and regulations surrounding R&D incentives can change frequently. Consultants stay abreast of these changes and can advise you on how to adjust your strategies accordingly, ensuring your business remains compliant and continues to benefit from available incentives.

- Strategic Planning: Beyond just the annual claim, consultants can provide strategic advice on how to plan and structure your R&D activities to maximize future tax incentives. This can be crucial for long-term financial planning and investment in innovation.

R&D tax credit FAQs

The four-part test as outlined in the Internal Revenue Code is used to determine qualified R&D activity.

The Four-Part Test

1). New Or Improved Business Component

Creation of a new product, process, formula, invention, software, or technique; or improving the performance, functionality, quality, or reliability of existing business component.

- Construction of new buildings or renovation of existing buildings

- Invention of a software application

- Manufacturing of a new product or the improvement of the production process for an existing product

- Creation of design documentation

2). Technological In Nature

The activity fundamentally relies on principles of the physical or biological sciences, engineering, or computer science. A taxpayer does not need to obtain information that exceeds, expands or refines the common knowledge of skilled professionals in a particular field.

- Physics (relationship between mass, density and volume; loading as the

result of gravitational attraction) - Engineering (mechanical, electrical, civil, chemical)

- Computer science (theory of computation and design of computational systems)

3). Elimination Of Uncertainty

Uncertainty exists if the information available to the taxpayer does not establish the capability or method for developing or improving the business component, or the appropriate design of the business component.

- The capability of a manufacturer to create a part within the specified tolerances

- The appropriate method of overcoming unsuitable soil conditions during construction

- The appropriate software design to meet quality and volatility requirements

4). Process Of Experimentation

A process designed to evaluate one or more alternatives to achieve a result where the capability or method of achieving that result, or the appropriate design of that result, is uncertain as of the beginning of the taxpayer’s research activities.

- Systematic process of trial and error

- Evaluating alternative means and methods

- Computer modeling or simulation Prototyping Testing

The R&D tax credit is one of the most misunderstood tax incentives available. Considering the myriad of industries and activities that legally qualify for the credit, the term “research and development” is a misnomer. Additionally, the R&D tax credit requires specialized knowledge and technology to identify and calculate the incentive properly.

Companies of various industries are unaware that they are eligible to claim the R&D tax credit. Under the Internal Revenue Code’s definition of R&D, many common activities qualify. Our specialists have successfully identified and delivered tax benefits for clients in industries including architecture, engineering, construction, manufacturing, and technology. Additionally, the following industries also qualify for the R&D tax credit:

Each tax credit study is tailored to ensure that TaxRobot can analyze the required information and perform the necessary calculations to meet the needs of each client. A typical tax credit study lasts about six weeks, however, in the event of a pressing deadline, Parachor can complete a study in as quickly as one week.

Each tax credit study is tailored to ensure that TaxRobot can analyze the required information and perform the necessary calculations to meet the needs of each client. A typical tax credit study lasts about six weeks, however, in the event of a pressing deadline, Parachor can complete a study in as quickly as one week.

Partnerships and S corporations must file this form to claim the credit. The credit will flow from the Form 6765, to the Schedule K-1, to the Form 3800 on the individual’s tax return. For individuals receiving this credit that have ownership interest in a partnership or S corporation, Form 6765 is not required on the individual return.

TaxRobot is not an accounting firm, we focus specifically on the R&D tax credit. We partner with CPA firms to complement their services and deliver benefit to their clients.

Individuals claiming this credit can report the credit directly on Form 3800, General Business Credit if their only source for the credit is a partnership, S corporation, estate, or trust. Otherwise, Form 6765 must be filed with the individual’s tax return (e.g. sole proprietorship).

For tax years prior to 2016, the credit can be used to reduce the taxpayer’s regular tax liability down to the tentative minimum tax. The credit cannot be used to offset alternative minimum tax. Beginning in tax year 2016, eligible small businesses have expanded utilization for the credit. For these eligible small businesses, the regular tax liability can offset alternative minimum tax using the “25/25” rule.