Save Up To $26K Per Employee With ERC For Startups

- Limited Time Offer

- Simple Onboarding

- Easy to Use

Trusted By:

Using Tax Robot

- Trusted by 100's Of Companies for Accuracy

- Quick & Easy Setup Processes

- Onboard in Minutes - Save Time Now

- Free VIP Onboarding - No Additional Fees

- Passionate In-House Customer Support

Other Tax Credit Companies

- Not Reliable or Accurate

- Complicated & Time Consuming

- Time Consuming Onboarding

- Hidden Fees, Upsells, Paid Addons

- Bad Outsourced Customer Support

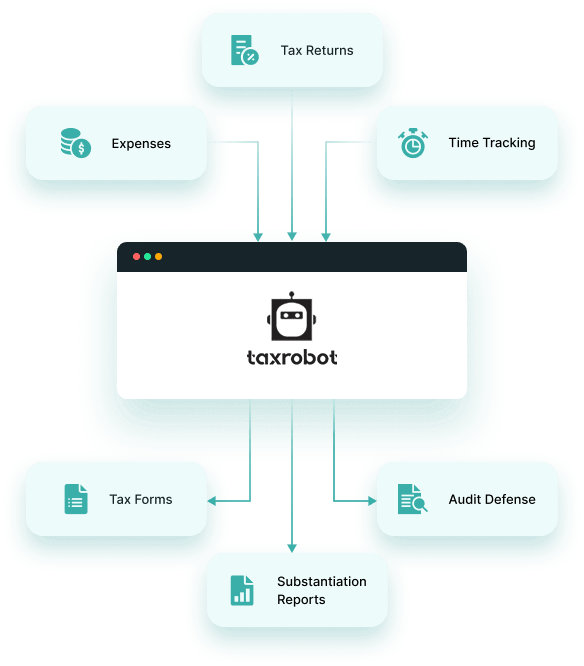

How it Works

You can now complete your employee retention tax credit claim in half the time without sacrificing the quality of the analysis and the reporting that supports it.

Provide Your Information

Link Your Systems

Receive Your Refund

Why TaxRobot?

Employee Retention Tax Credit Experts

TaxRobot was founded by subject matter experts with experience running an R&D and Employee Retention tax advisory firm delivering millions of dollars to hundreds of clients nation-wide.

Audit Defense

We don’t make excuses – we stand behind our work. In the event of an audit, we’ll step in to handle questions and respond to requests.

Value-Based Pricing

We don’t get paid unless you do. If you don’t receive a tax credit, we don’t charge a fee.

Bigger Refunds

Our expertise allows us to identify benefit where others fail to. Our clients have seen up to 3X the amount of tax credit compared with competing consultants and software products.

Save Time

We value your time. Let our algorithms do the heavy lifting so you can get back to what you do best – running your business.

Superior Documentation

Our audit-proof paperwork satisfies all statutory and IRS-recommended reporting requirements.

Employee Retention

Tax Credit FAQs

1. Your trade or business was fully or partially suspended or had to reduce business hours due to a government order. The credit applies for the portion of the quarter the business is suspended, not the entire quarter.

2. Your trade or business had a significant decline in gross receipts.

2020: if gross receipts in a calendar quarter are below 50% of gross receipts when compared to the same calendar quarter in 2019, your business will qualify.

2021: if gross receipts in a calendar quarter are below 20% of gross receipts when compared to the same calendar quarter in 2019, your business will qualify.

3. Recovery Startup Business: if your business started after February 15th, 2020, had annual gross receipts that are less than $1 million

The wages of any majority owner (greater than 50% ownership) do not qualify for the ERTC. Additionally, any related individual’s wages with the following relationships do not qualify for the ERTC:

- A child or a descendant of a child.

- A brother, sister, stepbrother, or stepsister.

- The father or mother, or an ancestor of either.

- A stepfather or stepmother.

- A niece or nephew.

- An aunt or uncle.

- A son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or

sister-in-law. - An individual (other than a spouse, determined without regard to section 7703 ,

of the taxpayer) who, for the taxable year of the taxpayer, has the same

principal place of abode as the taxpayer and is a member of the taxpayer’s

household.

Per the American Rescue Plan Act, a business that opened its doors during the pandemic can receive the credit. Your startup may be eligible if you meet the following criteria.

- You started your business on or after February 15, 2020.

- Your annual gross receipts don’t exceed $1 million for the individual 2020 and 2021 tax years.

- You have one or more W2 employees, not including owner-operators or family members.

In addition, if you purchased an existing business that was in operation on or before February 15, 2020, you may or may not be considered a recovery startup business. It all depends on your unique circumstances.