Lets help you get up to $9,600 per qualifying employee today.

The Work Opportunity Tax Credit (“WOTC”) is a federal tax credit for businesses hiring job seekers that have traditionally faced barriers to employment in the past.

- Free Consultation

- Quick Setup

- Rapid Results

Trusted By:

Jinesh Patel

As a former R&D tax credit consultant myself, I see tremendous value in TaxRobot. They are fast, accurate, efficient, and have true experts supporting you through the process. I highly recommend them to anyone considering an R&D Tax Credit software to complete their analysis.

Why choose TaxRobot

WOTC calculations?

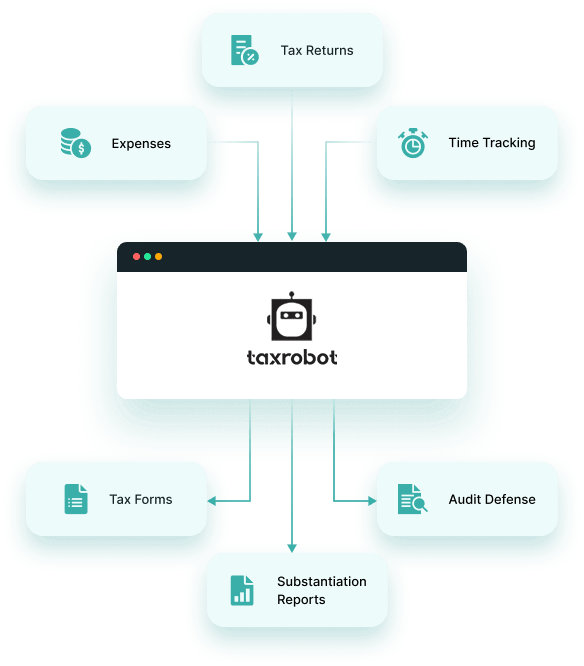

TaxRobot takes the guess work out of claiming tax credits by automating the process with technology. It is now possible to maximize your WOTC tax credit and create audit-proof documentation in a fraction of the time that it takes with a traditional tax credit study. The founders of TaxRobot are true subject matter experts with extensive experience calculating, substantiating, and defending the WOTC tax credit.

- Maximize your benefit

- Reduce audit risk

- Free audit defense

- Straightforward process

We make the WOTC tax credit simple.

A Message from our Founders

With TaxRobot, we have taken our 15+ years of experience in tax consulting and used it to create the most comprehensive tax credit software on the market. Working for large consulting firms helped us learn the best processes, but also showed us there’s often a lot left on the table when it comes to tax credit calculations. Our software provides the same expertise of large firms, while eliminating human error. The best part is that in addition to a robust tax credit software, you will always have access to industry experts who support the calculation.

Using TaxRobot

- Quick and Easy Process

- Comprehensive Documentation

- Value-Based Pricing

- Audit Defense

- Maximum Credit Calculations

Using tax credit consultants

- Complicated & Time Consuming

- Little to No Documentation

- Expensive

- Audit “Support”

- Money Left on the Table

How it Works

Our software takes a comprehensive WOTC tax credit process developed by subject matter experts and reduces it to three simple steps. You can now complete your tax credit claim in half the time without sacrificing the quality of the analysis and the reporting that supports it.

Provide Your Information

Link Your Systems

Receive Your Refund

Work Opportunity

Tax Credit FAQs

Businesses can claim this tax credit against federal taxable income for the year that the credit was earned. This credit is non-refundable, which means the business must have tax liability to offset. However, if you are unable to use the full amount of the credit in any given year, you may carry the credit back one year and carry it forward for up to 20 years.

The employee must complete IRS Form 8850, and the business must complete ETA Form 9061 or ETA Form 9062. These two forms must be sent to the designated local agency to certify the employee for the WOTC program.

Businesses that hire unemployed veterans, individuals on specific welfare programs, ex-felons, and individuals with disabilities will receive a tax credit if the jobseeker works at least 120 hours.

The rules for this program are ever-changing. Let Parachor help you manage your WOTC program to identify candidates, calculate credits, and submit WOTC applications so you can get a tax credit for giving target group job seekers an opportunity.

Disabled veterans with a service-connected disability who have been unemployed for at least six months

Veterans who have been unemployed for at least six months

Disabled veterans with a service-connected disability

Veterans receiving Supplemental Nutrition Assistance Program (SNAP) benefits

Veterans who have been unemployed for at least four weeks

Long-Term Family Assistance recipients who are members of a family that has received Temporary Assistance for Needy Families (TANF) benefits for at least 18 consecutive months

TANF recipients

Ex-felons

Designated community residents

Vocational rehabilitation referrals

SNAP (food stamp) recipients

Supplemental Security Income recipients

Long-Term Unemployment Recipients

Summer Youth program participants who are 16 to 17 years old, work between May 1 and September 15 and live in an empowerment zone

The credit to for-profit employers is 25% of qualified first-year wages for those employed at least 120 hours but fewer than 400 hours, and 40% for those employed 400 hours or more. For Long-Term Family Assistance recipients, WOTC is based on a two-year retention period. However, there is a maximum amount of tax credit that can be generated for each employee, which is displayed in the chart below.

Veteran Target Group | Maximum Tax Credit |

Disabled veterans with a service-connected disability who have been unemployed for at least six months | $9,600 |

Veterans who have been unemployed for at least six months | $5,600 |

Disabled veterans with a service-connected disability | $4,800 |

Veterans receiving Supplemental Nutrition Assistance Program (SNAP) benefits | $2,400 |

Veterans who have been unemployed for at least four weeks | $2,400 |

|

|

Non-Veteran Target Group | Maximum Tax Credit |

Long-Term Family Assistance recipients who are members of a family that has received Temporary Assistance for Needy Families (TANF) benefits for at least 18 consecutive months | $9,000 |

TANF recipients | $2,400 |

Ex-felons | |

Designated community residents | |

Vocational rehabilitation referrals | |

SNAP recipients | |

Supplemental Security Income recipients | |

Long-Term Unemployment Recipients | |

Summer Youth program participants who are 16 to 17 years old, work between May 1 and September 15 and live in an empowerment zone | $1,200 |

On or before the day that an offer of employment is made, the employer and the job applicant must complete Form 8850 (Pre-Screening Notice and Certification Request for the Work Opportunity Credit). The employer has 28 calendar days from the new employee’s start date to submit Form 8850 to the designated local agency located in the state in which the business is located (where the employee works). Additionally, the employer must complete and submit ETA Form 9061 (Individual Characteristics Form) within 28 days of the employee’s start date to the designated local agency. The employer will then file a Form 5884 on their tax return to calculate and claim the work opportunity tax credit against income taxes.