California R&D Credit

Let TaxRobot help you reduce your tax bill and handle all the hassles behind claiming the California R&D tax credit.

Maximize your State Credits today!

Put the R&D tax credit process on autopilot.

Trusted By:

California R&D Credit

Discover your eligibility for California R&D tax credits and supercharge your enterprise.

The R&D Tax Credit in California

With the state’s R&D tax credit, you can claim up to 15% of expenses that you spend on research and development. However, while the credit will reduce your tax bill, it is non-refundable, so you can’t get a direct cash refund. Instead, you can use the amount you qualify for to reduce your taxes the following year.

In order to count, your R&D activities must be done in California. If you have a company that operates in other states, it is important to be sure that the work related to R&D happened in California, not another state or abroad. You’ll need to complete Form 3523 from the California Franchise Tax Board. Each taxpayer can get back up to $5 million in business tax credits beginning with the 2020 taxable year.

Federal R&D Tax Credit

In addition to claiming the California R&D credit, businesses can also claim the federal tax credit. If you’re developing or improving your products, technology, or processes, claiming both of these credits can dramatically reduce your tax bill.

Do You Qualify?

If you’re uncertain whether your business and its activities qualify for either the federal or California tax credits, you’ll need to pay attention to a few guidelines. In general, the qualifications are similar for both the state and federal credits. To make things easier, you can use R&D tax credit software that will determine what is eligible and how much you can claim.

Qualifying Activities

In order for your research activities to qualify, they must meet the following guidelines set by the California Franchise Tax Board:

- Meet IRC Section 174 requirements as a business deduction

- Develop information of a technological nature

- Develop information that can be used to develop or improve a business component

- At least 80% of the activities must use a process of experimentation

Qualifying Expenses

In general, you can claim the following as qualifying expenses:

- Employee wages

- Contracted research

- Supplies

Certain other technologies, as outlined by the IRS, may also count as part of your qualified research expenses. If you are unsure if your expenses qualify, you can check with them to see everything that falls under this category.

Keep Thorough Documentation

Unfortunately, California generally uses the IRS’s guidelines when it comes to tax credit documentation. This is quite vague in its requirements. You need to document the expenses as they happen and provide proof that the work happened during the year you’re claiming. You also need to be able to prove the challenges that your R&D work helped to overcome. Estimates do not usually count as documentation.

Your returns can be audited up to four years after the filing date. If you don’t have proof for your claims, tax collectors can disallow your credit.

When you use TaxRobot, you don’t need to worry about whether your documentation will protect you. We provide audit-proof documentation that substantiates your claims. Plus, with our audit defense, we’ll handle any questions or requests that come your way if you are audited.

Let TaxRobot Find the Credits You’re Eligible For

Figuring out which activities and expenses qualify for the federal and California R&D tax credit can be overwhelming. Once you add the need to keep documentation, it can be too much for some business owners.

TaxRobot is a software program for taxpayers and CPAS that takes the burden off your shoulders. We’ll maximize your credit and protect you in case you are audited. All that’s left to do is get started.

How Much Could You Save With the California R&D Tax Credit

Curious about how much you could save on your tax bill through the California R&D credit? Use our calculator to find out!

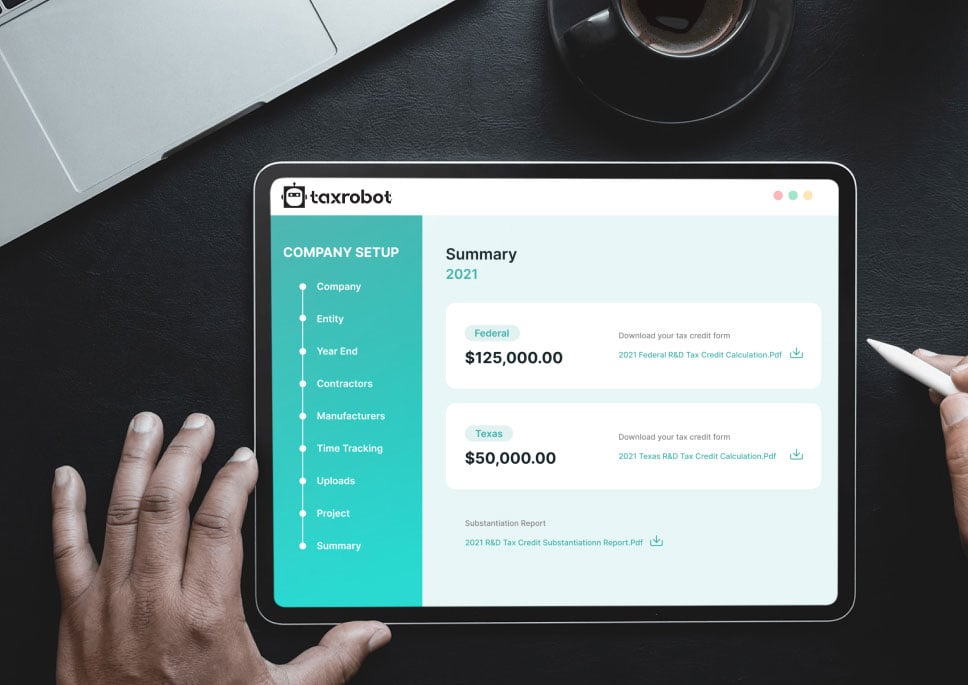

Take a sneak peak

- Limited Time Offer

- Simple Onboarding

- Easy to Use

R&D Tax Credits FAQs

The four-part test as outlined in the Internal Revenue Code is used to determine qualified R&D activity.

The Four-Part Test

1). New Or Improved Business Component

Creation of a new product, process, formula, invention, software, or technique; or improving the performance, functionality, quality, or reliability of existing business component.

- Construction of new buildings or renovation of existing buildings

- Invention of a software application

- Manufacturing of a new product or the improvement of the production process for an existing product

- Creation of design documentation

2). Technological In Nature

The activity fundamentally relies on principles of the physical or biological sciences, engineering, or computer science. A taxpayer does not need to obtain information that exceeds, expands or refines the common knowledge of skilled professionals in a particular field.

- Physics (relationship between mass, density and volume; loading as the

result of gravitational attraction) - Engineering (mechanical, electrical, civil, chemical)

- Computer science (theory of computation and design of computational systems)

3). Elimination Of Uncertainty

Uncertainty exists if the information available to the taxpayer does not establish the capability or method for developing or improving the business component, or the appropriate design of the business component.

- The capability of a manufacturer to create a part within the specified tolerances

- The appropriate method of overcoming unsuitable soil conditions during construction

- The appropriate software design to meet quality and volatility requirements

4). Process Of Experimentation

A process designed to evaluate one or more alternatives to achieve a result where the capability or method of achieving that result, or the appropriate design of that result, is uncertain as of the beginning of the taxpayer’s research activities.

- Systematic process of trial and error

- Evaluating alternative means and methods

- Computer modeling or simulation Prototyping Testing

The R&D tax credit is one of the most misunderstood tax incentives available. Considering the myriad of industries and activities that legally qualify for the credit, the term “research and development” is a misnomer. Additionally, the R&D tax credit requires specialized knowledge and technology to identify and calculate the incentive properly.

Companies of various industries are unaware that they are eligible to claim the R&D tax credit. Under the Internal Revenue Code’s definition of R&D, many common activities qualify. You can get tax benefits for industries including software, technology, architecture, engineering, construction, manufacturing, and more.

The R&D tax credit can be claimed for all open tax years. Generally, open tax years include the prior three tax years due to the statute of limitations period. In certain circumstances, the law allows businesses to claim the R&D tax credit for an extended period of time. It is common for companies to amend previous tax years to claim this benefit and reduce the maximum amount of tax liability.

Partnerships and S corporations must file this form to claim the credit. The credit will flow from the Form 6765, to the Schedule K-1, to the Form 3800 on the individual’s tax return. For individuals receiving this credit that have ownership interest in a partnership or S corporation, Form 6765 is not required on the individual return.

Individuals claiming this credit can report the credit directly on Form 3800, General Business Credit if their only source for the credit is a partnership, S corporation, estate, or trust. Otherwise, Form 6765 must be filed with the individual’s tax return (e.g. sole proprietorship).

For tax years prior to 2016, the credit can be used to reduce the taxpayer’s regular tax liability down to the tentative minimum tax. The credit cannot be used to offset alternative minimum tax. Beginning in tax year 2016, eligible small businesses have expanded utilization for the credit. For these eligible small businesses, the regular tax liability can offset alternative minimum tax using the “25/25” rule.

What our customers have to say

I highly recommend TaxRobot to anyone considering an R&D Tax Credit software to complete their analysis.

We decided to switch to TaxRobot… Best decision we’ve ever made. More affordable, and less complicated.

I couldn’t believe how easy it was! In under an hour, we saved enough money to hire a new employee.