Georgia R&D Credit

Let Tax Robot help you get the most out of the Georgia R&D tax credit.

Maximize your State Credits today!

Put the R&D tax credit process on autopilot.

Trusted By:

Georgia R&D Credit

Discover your eligibility for Georgia R&D tax credits and supercharge your enterprise.

Does Georgia Have an R&D Tax Credit?

Yes, the Peach State has a program meant to reward businesses by providing an R&D tax credit. This program is based on the fact that Georgia companies investing in improving themselves are good for that state. It should lead to more jobs within the state and increase economic opportunities.

Research and Development Tax Credit

The research and development tax credit in Georgia is structured to be similar to the federal R&D tax credit. This makes it easier for companies to apply to both.

However, Georgia’s R&D tax credit only applies to qualified expenses within the state of Georgia. Using these expenses, the amount of the credit is equal to 10% of the total number of expenses over the base amount. This amount is then capped at 50% of the net income tax liability for Georgia after the application of other credits.

If there is any excess credit, it doesn’t just go to waste. The excess credit can be leveraged against state payroll withholding. In addition, unused credits are eligible to be carried forward. However, the period for carrying forward credits is limited to 10 years.

Federal R&D Tax Credit

As previously mentioned, the Georgia R&D tax credit is heavily based on the federal R&D tax credit. Applying for both is heavily encouraged.

The IRS has a guide to applying for this credit on its website. However, the guide is a little out of date, as it was created back in 2008. So, many people choose to trust updated systems, like those provided by TaxRobot, instead.

Does Your Business Qualify?

Not every business qualifies for the Georgia R&D tax credit. The company has to be actively engaged in research and development activities. These activities have to follow the federal guidelines for qualifying expenses.

Luckily, this is really the only requirement for a business. Companies ranging from simple partnerships to large corporations can apply for this credit as long as they have the right expenses.

Qualifying Expenses

The Georgia R&D tax credit is based on the federal tax credit. This means that the two systems share the same definition for what qualifies as an eligible expense for the credit.

These expenses have to be:

- Technological: The expenses can’t relate to just anything; they have to relate to some sort of technology or a scientific field.

- Related to creating something new: This creation will vary from business to business, depending on what they offer. It can be a product, service, or even process. So, one company may create a new type of television, but another may design a new method for creating microchips.

- Involved in eliminating uncertainty: Uncertainty surrounds many aspects of technology in business. Finding ways to eliminate this uncertainty qualifies for the R&D credit.

- Experimental: Experimentation is a necessary part of many companies’ processes. This could be testing one process over another or pitting two products against each other. In any case, it involves the definition of experimentation and, thus, qualifies for the credit.

Let TaxRobot Make It Easier to Claim the Georgia R&D Credit

There is a lot that goes into both the Georgia R&D tax credit and the federal R&D tax credit. Getting the most out of both requires an in-depth knowledge of the system, the ability to calculate the maximum possible credit, and the expertise to avoid making mistakes in this process.

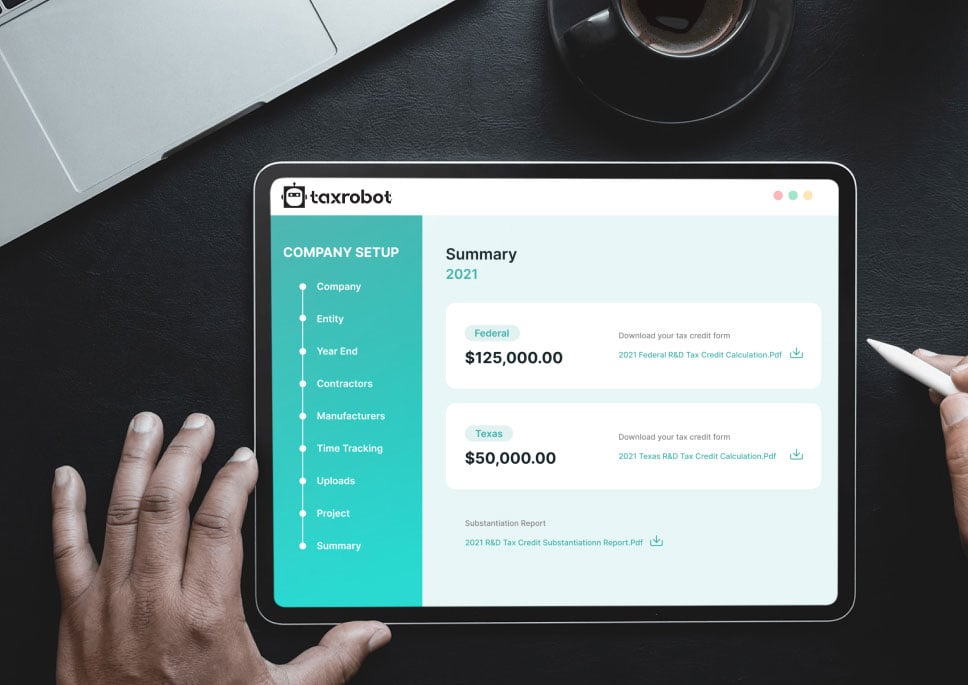

Because of all of these variables, many people choose to trust the experts at TaxRobot rather than taking on the task themselves. Our tax credit consulting can help determine exactly what your company can get when it comes to this tax credit. Then, our advanced software, alongside our experts, will complete the credit application for you.

How Much Could You Save with the Georgia R&D Credit?

Curious if the Georgia R&D credit could shave off a chunk of your tax bill? Find out how much you could save with our calculator.

Take a sneak peak

- Limited Time Offer

- Simple Onboarding

- Easy to Use

R&D Tax Credits FAQs

The four-part test as outlined in the Internal Revenue Code is used to determine qualified R&D activity.

The Four-Part Test

1). New Or Improved Business Component

Creation of a new product, process, formula, invention, software, or technique; or improving the performance, functionality, quality, or reliability of existing business component.

- Construction of new buildings or renovation of existing buildings

- Invention of a software application

- Manufacturing of a new product or the improvement of the production process for an existing product

- Creation of design documentation

2). Technological In Nature

The activity fundamentally relies on principles of the physical or biological sciences, engineering, or computer science. A taxpayer does not need to obtain information that exceeds, expands or refines the common knowledge of skilled professionals in a particular field.

- Physics (relationship between mass, density and volume; loading as the

result of gravitational attraction) - Engineering (mechanical, electrical, civil, chemical)

- Computer science (theory of computation and design of computational systems)

3). Elimination Of Uncertainty

Uncertainty exists if the information available to the taxpayer does not establish the capability or method for developing or improving the business component, or the appropriate design of the business component.

- The capability of a manufacturer to create a part within the specified tolerances

- The appropriate method of overcoming unsuitable soil conditions during construction

- The appropriate software design to meet quality and volatility requirements

4). Process Of Experimentation

A process designed to evaluate one or more alternatives to achieve a result where the capability or method of achieving that result, or the appropriate design of that result, is uncertain as of the beginning of the taxpayer’s research activities.

- Systematic process of trial and error

- Evaluating alternative means and methods

- Computer modeling or simulation Prototyping Testing

The R&D tax credit is one of the most misunderstood tax incentives available. Considering the myriad of industries and activities that legally qualify for the credit, the term “research and development” is a misnomer. Additionally, the R&D tax credit requires specialized knowledge and technology to identify and calculate the incentive properly.

Companies of various industries are unaware that they are eligible to claim the R&D tax credit. Under the Internal Revenue Code’s definition of R&D, many common activities qualify. You can get tax benefits for industries including software, technology, architecture, engineering, construction, manufacturing, and more.

The R&D tax credit can be claimed for all open tax years. Generally, open tax years include the prior three tax years due to the statute of limitations period. In certain circumstances, the law allows businesses to claim the R&D tax credit for an extended period of time. It is common for companies to amend previous tax years to claim this benefit and reduce the maximum amount of tax liability.

Partnerships and S corporations must file this form to claim the credit. The credit will flow from the Form 6765, to the Schedule K-1, to the Form 3800 on the individual’s tax return. For individuals receiving this credit that have ownership interest in a partnership or S corporation, Form 6765 is not required on the individual return.

Individuals claiming this credit can report the credit directly on Form 3800, General Business Credit if their only source for the credit is a partnership, S corporation, estate, or trust. Otherwise, Form 6765 must be filed with the individual’s tax return (e.g. sole proprietorship).

For tax years prior to 2016, the credit can be used to reduce the taxpayer’s regular tax liability down to the tentative minimum tax. The credit cannot be used to offset alternative minimum tax. Beginning in tax year 2016, eligible small businesses have expanded utilization for the credit. For these eligible small businesses, the regular tax liability can offset alternative minimum tax using the “25/25” rule.

What our customers have to say

I highly recommend TaxRobot to anyone considering an R&D Tax Credit software to complete their analysis.

We decided to switch to TaxRobot… Best decision we’ve ever made. More affordable, and less complicated.

I couldn’t believe how easy it was! In under an hour, we saved enough money to hire a new employee.