Maine R&D Credit

Maximize your R&D tax credit with TaxRobot.

Maximize your State Credits today!

Put the R&D tax credit process on autopilot.

Trusted By:

Maine R&D Credit

Discover your eligibility for Maine R&D tax credits and supercharge your enterprise.

Are There R&D Credits for Maine?

Businesses in Maine that conduct research and development are eligible for a few types of credits. The state offers both a research expense credit and sales tax exemptions. Plus, businesses may qualify for the closely related federal R&D credit. There also used to be a super credit, though this was eliminated after 2013.

Research Expense Tax Credit

Maine’s research expense tax credit is very similar and based on the federal credit. This makes it relatively simple to calculate. It is based on statute 36 §5219-K. The amount of the credit is 5% of the excess QREs compared to the average of the previous three years, plus 7.5% of the basic research payments. It is important to note that expenses must be incurred in the state of Maine.

The credit is capped at 100% of the first $25,000 in corporate tax liability and 75% of the liability over $25,000. The credit cannot be retroactively applied but may be carried forward for up to 15 years.

Sales Tax Exemptions

In addition, the state also offers sales tax exemptions for expenses related to certain activities and industries. These include research and development, manufacturing, biotechnology, fuel and electricity, and custom computer programming.

Federal R&D Credit

Since the Maine research expense credit is based on the federal one, there is a lot of overlap. If a business qualifies for the federal credit, the amount may be 6-8% of their QREs. Most businesses should be able to apply and qualify for both, maximizing their credit.

R&D Credit Qualifications

To qualify for the credit, both your expenses and business must meet a few requirements. Eligible entities include C and S corporations, LLCs, and partnerships. Controlled groups and other taxpayers using a combined return must follow special rules. These businesses may want to work with a tax credit consultant to make sure they maximize their credit while meeting the requirements.

Expenses for the sales tax exemption must be used in their applicable sector. In addition, they must be consumed or used directly for that purpose and that purpose only.

Requirements for expenses for the research expense credit are very similar to those for the federal credit. This means qualified research activities and their expenses must pass a four-part test. They must:

- Be technological in nature: Activities must rely on the principles of computer, science, engineering, or physical or biological science.

- Be of a permitted purpose: The activity must attempt to improve a new or existing product, service, or process of the business.

- Eliminate uncertainty: It must eliminate any technical uncertainty about the improvement or development of the product.

- Include a process of experimentation: Activities must follow a process of experimentation that includes modeling, testing, simulating, or systematic trial and error.

Applying For the Credit

To apply for the credit, a business must document its qualified research expenses for the previous three years. They must also use federal Form 6765. The deadline for filing for the credit is the same as that of the Maine tax return.

Maximize Your R&D Credits with TaxRobot

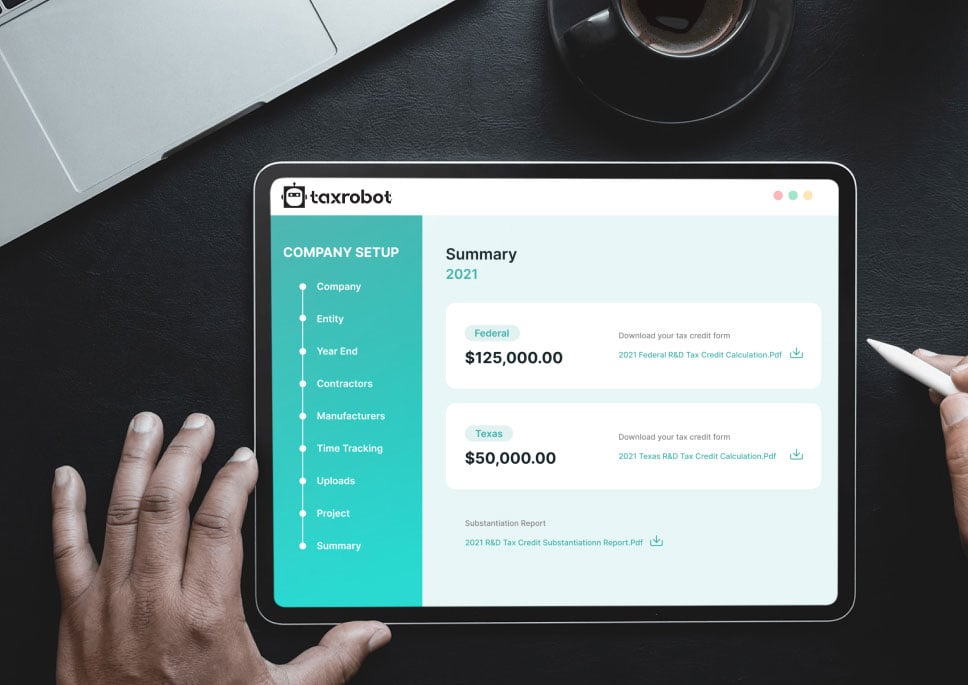

With three possible R&D credits available in Maine, some business owners may get a bit overwhelmed. Luckily, TaxRobot can make it easier to apply for these credits. When you answer a few questions, we’ll be able to gather some key information that will help our software figure out the maximum amount of credit you are eligible for. Plus, we’ll help you file and document the credit and even back you up should you ever be audited.

How Much Could You Save with the Maine R&D Credit?

Curious about just how big your tax savings could be with the Maine R&D credit? Try our calculator and get an instant estimate.

Take a sneak peak

- Limited Time Offer

- Simple Onboarding

- Easy to Use

R&D Tax Credits FAQs

The four-part test as outlined in the Internal Revenue Code is used to determine qualified R&D activity.

The Four-Part Test

1). New Or Improved Business Component

Creation of a new product, process, formula, invention, software, or technique; or improving the performance, functionality, quality, or reliability of existing business component.

- Construction of new buildings or renovation of existing buildings

- Invention of a software application

- Manufacturing of a new product or the improvement of the production process for an existing product

- Creation of design documentation

2). Technological In Nature

The activity fundamentally relies on principles of the physical or biological sciences, engineering, or computer science. A taxpayer does not need to obtain information that exceeds, expands or refines the common knowledge of skilled professionals in a particular field.

- Physics (relationship between mass, density and volume; loading as the

result of gravitational attraction) - Engineering (mechanical, electrical, civil, chemical)

- Computer science (theory of computation and design of computational systems)

3). Elimination Of Uncertainty

Uncertainty exists if the information available to the taxpayer does not establish the capability or method for developing or improving the business component, or the appropriate design of the business component.

- The capability of a manufacturer to create a part within the specified tolerances

- The appropriate method of overcoming unsuitable soil conditions during construction

- The appropriate software design to meet quality and volatility requirements

4). Process Of Experimentation

A process designed to evaluate one or more alternatives to achieve a result where the capability or method of achieving that result, or the appropriate design of that result, is uncertain as of the beginning of the taxpayer’s research activities.

- Systematic process of trial and error

- Evaluating alternative means and methods

- Computer modeling or simulation Prototyping Testing

The R&D tax credit is one of the most misunderstood tax incentives available. Considering the myriad of industries and activities that legally qualify for the credit, the term “research and development” is a misnomer. Additionally, the R&D tax credit requires specialized knowledge and technology to identify and calculate the incentive properly.

Companies of various industries are unaware that they are eligible to claim the R&D tax credit. Under the Internal Revenue Code’s definition of R&D, many common activities qualify. You can get tax benefits for industries including software, technology, architecture, engineering, construction, manufacturing, and more.

The R&D tax credit can be claimed for all open tax years. Generally, open tax years include the prior three tax years due to the statute of limitations period. In certain circumstances, the law allows businesses to claim the R&D tax credit for an extended period of time. It is common for companies to amend previous tax years to claim this benefit and reduce the maximum amount of tax liability.

Partnerships and S corporations must file this form to claim the credit. The credit will flow from the Form 6765, to the Schedule K-1, to the Form 3800 on the individual’s tax return. For individuals receiving this credit that have ownership interest in a partnership or S corporation, Form 6765 is not required on the individual return.

Individuals claiming this credit can report the credit directly on Form 3800, General Business Credit if their only source for the credit is a partnership, S corporation, estate, or trust. Otherwise, Form 6765 must be filed with the individual’s tax return (e.g. sole proprietorship).

For tax years prior to 2016, the credit can be used to reduce the taxpayer’s regular tax liability down to the tentative minimum tax. The credit cannot be used to offset alternative minimum tax. Beginning in tax year 2016, eligible small businesses have expanded utilization for the credit. For these eligible small businesses, the regular tax liability can offset alternative minimum tax using the “25/25” rule.

What our customers have to say

I highly recommend TaxRobot to anyone considering an R&D Tax Credit software to complete their analysis.

We decided to switch to TaxRobot… Best decision we’ve ever made. More affordable, and less complicated.

I couldn’t believe how easy it was! In under an hour, we saved enough money to hire a new employee.