Nevada R&D Tax Credit

With TaxRobot, Nevada R&D Tax Credit becomes more than a benefit—it becomes a catalyst for your business growth. Unleashing the incredible, simplifying the complex. This is not just tax planning; it’s financial evolution.

Maximize your State Credits today!

Put the R&D tax credit process on autopilot.

Trusted By:

Nevada R&D Tax Credit

Discover your eligibility for Nevada R&D tax credits and supercharge your enterprise.

Nevada R&D Tax Credit: What You Need to Know

Welcome to the world of R&D tax credits in Nevada, where innovation meets financial rewards. If you’re a business owner or tax professional seeking to unlock greater tax benefits for your research and development activities, you’ve arrived at the perfect destination.

At TaxRobot, we’re not your ordinary tax software. Our AI-powered solution takes the complexities out of calculating R&D tax credits, providing a hassle-free experience that guarantees maximum refunds.

With our team of experts, who have successfully delivered millions of dollars in tax credits nationwide, you can trust our unparalleled expertise.

Understanding the Nevada R&D Tax Credit Landscape

Although Nevada doesn’t offer a state-level R&D tax credit, businesses in the state can still qualify for the valuable Federal R&D Tax Credit.

This federal credit presents a tremendous opportunity for companies engaged in research and development activities in Nevada. At TaxRobot, we specialize in navigating the intricacies of R&D tax credits, ensuring you get all the financial benefits you deserve.

Discover how TaxRobot can help your company leverage the Federal R&D Tax Credit and propel your research and development initiatives forward in Nevada.

Eligibility for Federal R&D Tax Credit

The Federal R&D Tax Credit substantially benefits companies engaged in qualifying research and development activities.

To be eligible, businesses must meet specific criteria:

- The activities must be technological in nature, relying on principles of physical or biological sciences, engineering, or computer science.

- The purpose should be to improve a business component’s functionality, performance, reliability, or quality.

- The activities should also eliminate technical uncertainties in product development or improvement.

- Additionally, a systematic process of experimentation, such as testing, modeling, or trial and error, must be involved.

At TaxRobot, we specialize in helping businesses understand and meet eligibility requirements, ensuring they can maximize their benefits from the Federal R&D Tax Credit.

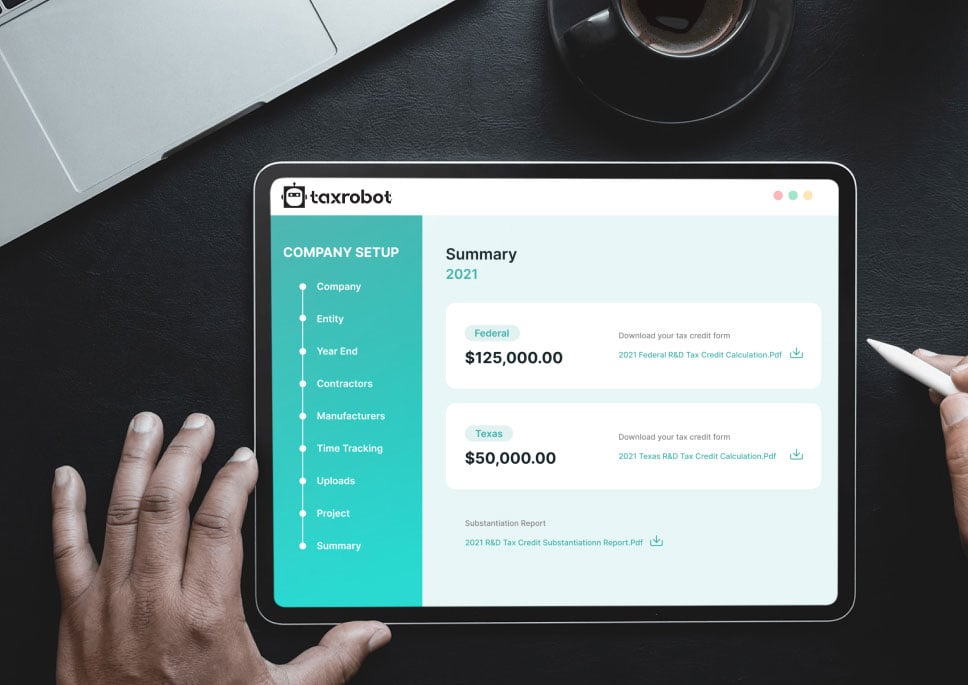

Streamline Your R&D Tax Credit Process With TaxRobot

Say goodbye to the complexities and tediousness of the R&D tax credit process. With TaxRobot, we simplify and streamline the entire journey for you. Our user-friendly software ensures a seamless experience, enabling you to focus on what truly matters—running your business.

The three-step process is as easy as providing information, linking systems, and receiving your well-deserved refund. Our AI-powered platform saves you valuable time while delivering accurate results.

Moreover, our commitment to superior documentation ensures compliance with statutory and IRS reporting requirements.

Let TaxRobot handle the intricacies of your R&D tax credit process, so you can concentrate on fueling innovation and driving your business forward.

Value-Based Pricing and Comprehensive Support

At TaxRobot, we prioritize your satisfaction and financial success. That’s why we offer value-based pricing, ensuring you only pay a fee if you receive a tax credit. Our commitment is aligned with your best interests, guaranteeing that we are invested in maximizing your benefits.

Additionally, our comprehensive support extends beyond calculations. In the event of an audit, rest assured, knowing that TaxRobot has your back. We provide audit support at no extra cost, handling any inquiries or requests that may arise.

With our accurate algorithms, superior documentation, and unwavering support, you can confidently entrust your R&D tax credit journey to TaxRobot.

Experience peace of mind, and let us help you optimize your R&D tax credits while minimizing administrative burdens.

Maximize Your R&D Tax Credits in Nevada with TaxRobot

When it comes to unlocking the full potential of R&D tax credits in Nevada, TaxRobot is your trusted partner. Our AI-powered software, combined with our expert team, simplifies the complex process and ensures you receive the maximum benefits.

By leveraging our extensive experience and in-depth knowledge, we guide you through the eligibility requirements, streamline the tax credit process, and provide comprehensive support.

With value-based pricing and audit assistance, we prioritize your success and satisfaction.

Trust TaxRobot to optimize your R&D tax credit strategy, fuel innovation, and drive your business forward.

Take a sneak peak

- Limited Time Offer

- Simple Onboarding

- Easy to Use

R&D Tax Credits FAQs

The four-part test as outlined in the Internal Revenue Code is used to determine qualified R&D activity.

The Four-Part Test

1). New Or Improved Business Component

Creation of a new product, process, formula, invention, software, or technique; or improving the performance, functionality, quality, or reliability of existing business component.

- Construction of new buildings or renovation of existing buildings

- Invention of a software application

- Manufacturing of a new product or the improvement of the production process for an existing product

- Creation of design documentation

2). Technological In Nature

The activity fundamentally relies on principles of the physical or biological sciences, engineering, or computer science. A taxpayer does not need to obtain information that exceeds, expands or refines the common knowledge of skilled professionals in a particular field.

- Physics (relationship between mass, density and volume; loading as the

result of gravitational attraction) - Engineering (mechanical, electrical, civil, chemical)

- Computer science (theory of computation and design of computational systems)

3). Elimination Of Uncertainty

Uncertainty exists if the information available to the taxpayer does not establish the capability or method for developing or improving the business component, or the appropriate design of the business component.

- The capability of a manufacturer to create a part within the specified tolerances

- The appropriate method of overcoming unsuitable soil conditions during construction

- The appropriate software design to meet quality and volatility requirements

4). Process Of Experimentation

A process designed to evaluate one or more alternatives to achieve a result where the capability or method of achieving that result, or the appropriate design of that result, is uncertain as of the beginning of the taxpayer’s research activities.

- Systematic process of trial and error

- Evaluating alternative means and methods

- Computer modeling or simulation Prototyping Testing

The R&D tax credit is one of the most misunderstood tax incentives available. Considering the myriad of industries and activities that legally qualify for the credit, the term “research and development” is a misnomer. Additionally, the R&D tax credit requires specialized knowledge and technology to identify and calculate the incentive properly.

Companies of various industries are unaware that they are eligible to claim the R&D tax credit. Under the Internal Revenue Code’s definition of R&D, many common activities qualify. You can get tax benefits for industries including software, technology, architecture, engineering, construction, manufacturing, and more.

The R&D tax credit can be claimed for all open tax years. Generally, open tax years include the prior three tax years due to the statute of limitations period. In certain circumstances, the law allows businesses to claim the R&D tax credit for an extended period of time. It is common for companies to amend previous tax years to claim this benefit and reduce the maximum amount of tax liability.

Partnerships and S corporations must file this form to claim the credit. The credit will flow from the Form 6765, to the Schedule K-1, to the Form 3800 on the individual’s tax return. For individuals receiving this credit that have ownership interest in a partnership or S corporation, Form 6765 is not required on the individual return.

Individuals claiming this credit can report the credit directly on Form 3800, General Business Credit if their only source for the credit is a partnership, S corporation, estate, or trust. Otherwise, Form 6765 must be filed with the individual’s tax return (e.g. sole proprietorship).

For tax years prior to 2016, the credit can be used to reduce the taxpayer’s regular tax liability down to the tentative minimum tax. The credit cannot be used to offset alternative minimum tax. Beginning in tax year 2016, eligible small businesses have expanded utilization for the credit. For these eligible small businesses, the regular tax liability can offset alternative minimum tax using the “25/25” rule.

What our customers have to say

I highly recommend TaxRobot to anyone considering an R&D Tax Credit software to complete their analysis.

We decided to switch to TaxRobot… Best decision we’ve ever made. More affordable, and less complicated.

I couldn’t believe how easy it was! In under an hour, we saved enough money to hire a new employee.