Oklahoma R&D Tax Credit

Welcome to TaxRobot, your long-term partner for effectively navigating Research & Development (R&D) tax credits in Oklahoma. Our AI-powered software streamlines the process, ensuring you maximize these valuable incentives effortlessly.

Maximize your State Credits today!

Put the R&D tax credit process on autopilot.

Trusted By:

Oklahoma R&D Tax Credits

Discover your eligibility for Oklahoma R&D tax credits and supercharge your enterprise.

Introducing TaxRobot's AI-Powered R&D Tax Software in Oklahoma

TaxRobot leverages cutting-edge artificial intelligence technology to simplify and optimize your R&D tax credit claims. Our intelligent software guides you through three easy steps:

- Provide Your Information: Start by giving us basic information about your business and its R&D activities.

- Link Your Systems: Connect TaxRobot to your accounting and payroll systems. Our software identifies qualifying activities and expenses based on the latest IRS guidelines.

- Receive Your Refund: TaxRobot calculates your potential R&D tax credit and provides a detailed report ready for submission to the IRS.

With TaxRobot, claiming your R&D tax credits is as easy as 1-2-3!

What is the R&D Tax Credit?

The R&D tax credit serves as a government initiative aimed at fostering innovation and stimulating expansion across sectors.

It provides a means for American companies to receive recognition and benefits for their increased research and development investments within the country. For Oklahoma businesses involved in qualifying research activities, these credits can really help reduce tax liability and boost cash flow.

What Activities Qualify for the Oklahoma R&D Tax Credit?

The IRS uses a four-part ranking to determine if an activity meets the qualifications of a R&D tax credit. Here’s what they look for:

- Technological in Nature: The activity should be based on hard science principles.

- Elimination of Uncertainty: The goal is to reduce product or process development uncertainty.

- Process of Experimentation: The activity should involve trying out different solutions or approaches.

- Qualified Purpose: The aim is to create new or improved functionality, performance, reliability, or quality for a business component.

Our AI-powered software is skilled at identifying these qualifying activities within your operations. If you need assistance identifying these qualifying expenses within your business, TaxRobot is here to help! Contact us today for an R&D consultation.

Documentation for the Oklahoma R&D Tax Credit

Proper documentation is crucial when claiming the R&D tax credit. Typical documentation includes:

- Project records

- Payroll records

- General ledger expense detail

- Organizational charts

- Project lists

TaxRobot assists in gathering and organizing the necessary documentation, ensuring a seamless claim process.

Contact TaxRobot’s R&D Tax Credit Experts

Looking for more personalized assistance? Our team of tax professionals is here to help! We’ve got you covered with R&D tax credit software designed specifically for tax professionals. It makes managing your clients’ R&D tax credit claims a breeze. Let us simplify your tax credit process! Contact us to get started.

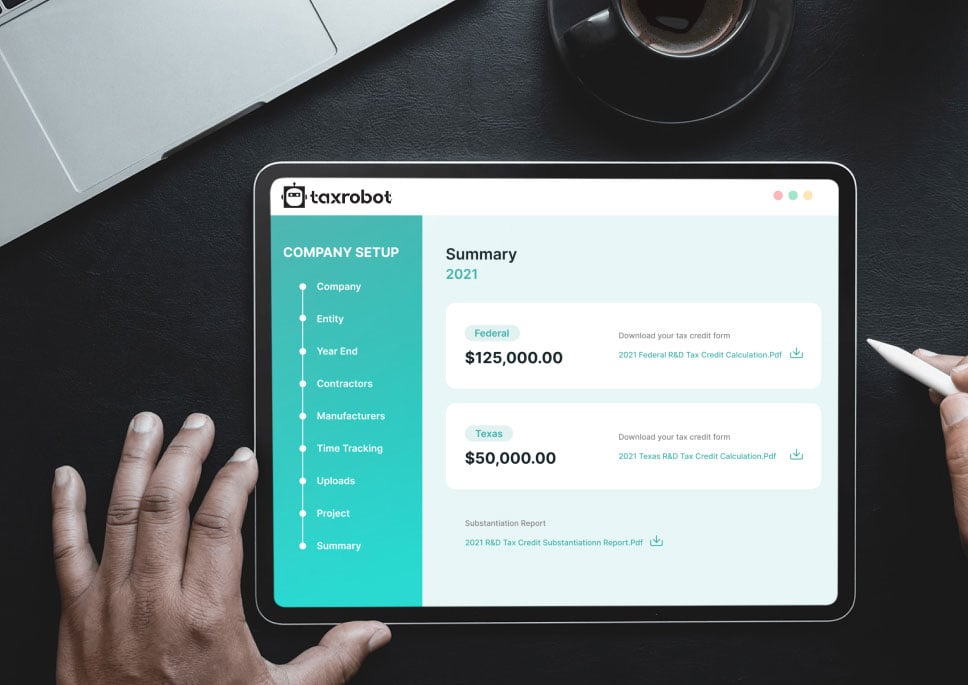

Take a sneak peak

- Limited Time Offer

- Simple Onboarding

- Easy to Use

R&D Tax Credits FAQs

For the RDC (basic research) tax credit, you can get 24 percent of the excess amount of your current-year basic research expenses over the calculated base-period amount. Just keep in mind that this credit may be reduced if you deduct a portion of your R&D expenditures for tax purposes.

Qualifying activities must meet the four-part test set forth by the IRS. These components include technological in nature, the process of experimentation, eliminating uncertainty, and a permitted purpose.

With TaxRobot, tracking and documenting your qualifying research expenses (QREs) is easy! Our software quickly captures costs associated with activities that meet the four-part test and provides a detailed report that can be used to prove your eligible R&D expenses. TaxRobot also allows you to easily compare the current year's R&D expenditures with prior years in order to determine your base-period amount for a larger credit.

Realizing the R&D tax credit comes with several benefits. You can receive state R&D tax credits for each dollar, amounting to around 12-16 cents. Moreover, these credits can directly offset your state income tax liability on a dollar, for dollar basis.

What our customers have to say

I highly recommend TaxRobot to anyone considering an R&D Tax Credit software to complete their analysis.

We decided to switch to TaxRobot… Best decision we’ve ever made. More affordable, and less complicated.

I couldn’t believe how easy it was! In under an hour, we saved enough money to hire a new employee.