Pennsylvania R&D Tax Credit

Welcome to TaxRobot! We’re your trusted ally when it comes to navigating the challenges of Research & Development (R&D) tax credits in Pennsylvania. Our AI-powered software will ensure you effortlessly and efficiently maximize these valuable incentives.

Maximize your State Credits today!

Put the R&D tax credit process on autopilot.

Trusted By:

Pennsylvania R&D Tax Credits

Discover your eligibility for Pennsylvania R&D tax credits and supercharge your enterprise.

The R&D Tax Credit and Its Importance

The R&D tax credit serves as a stimulus aimed at motivating companies across various sectors to invest in innovation within the United States. Its inception dates back to the Economic Recovery Tax Act of 1981, with the objective of fostering progress and driving economic growth.

The Trouble with Misunderstanding the New Amendments of the R&D Tax Credit

The R&D tax credit in Pennsylvania can be difficult to understand and follow. Misunderstanding the new amendments could lead to costly mistakes, leaving businesses unprepared for filing taxes and putting them at risk of penalties.

Our dedicated team here at TaxRobot comprises engineers and financial experts who have put in the effort to ensure that our software comprehends the complex nuances of the R&D tax credit. Our advanced AI system swiftly and accurately analyzes texts enabling us to provide you with the most precise information regarding R&D tax credits available in Pennsylvania.

What Are the Benefits of Using TaxRobot for Your Pennsylvania Business?

Using TaxRobot to manage your R&D tax credits offers numerous benefits for your business:

- Our software is precise, ensuring that you receive the most up-to-date information about the R&D tax credit in Pennsylvania.

- We offer detailed and comprehensive reports to ensure your business remains compliant with state laws.

- Our AI technology helps you maximize R&D tax credits for your business.

- TaxRobot also provides tools that can help you make informed decisions regarding your taxes.

- Our software is designed to be user-friendly and highly efficient, ensuring you can easily and swiftly access the information you need.

Why Should You Choose TaxRobot in Pennsylvania?

Here at TaxRobot, we truly value our customers. We take pride in delivering top-notch service. We understand that tackling tax filings can feel overwhelming, which is why our team of experts is readily available. Rest assured. Our customer service representatives are dedicated to providing guidance and support throughout your TaxRobot journey.

Commitment to Accuracy

Our commitment to accuracy and precision is unwavering. We utilize the technologies and adhere to industry best practices ensuring that your tax calculations are handled with utmost care.

Expertise in R&D Credits

Moreover, our team of tax professionals possesses expertise on the R&D tax credits in Pennsylvania, guaranteeing you receive expert advice tailored specifically for your needs.

So, whether it’s a simple question or more complex subject matter, our team is available to help.

Our team fully comprehends that the process of filing taxes can often be quite intricate.

Contact Us Today

However, our dedicated team is readily available to provide assistance and guidance. If you have any inquiries regarding the R&D tax credit, please feel free to reach out to us without any hesitation. We would be delighted to furnish you with details and address any concerns or queries you have.

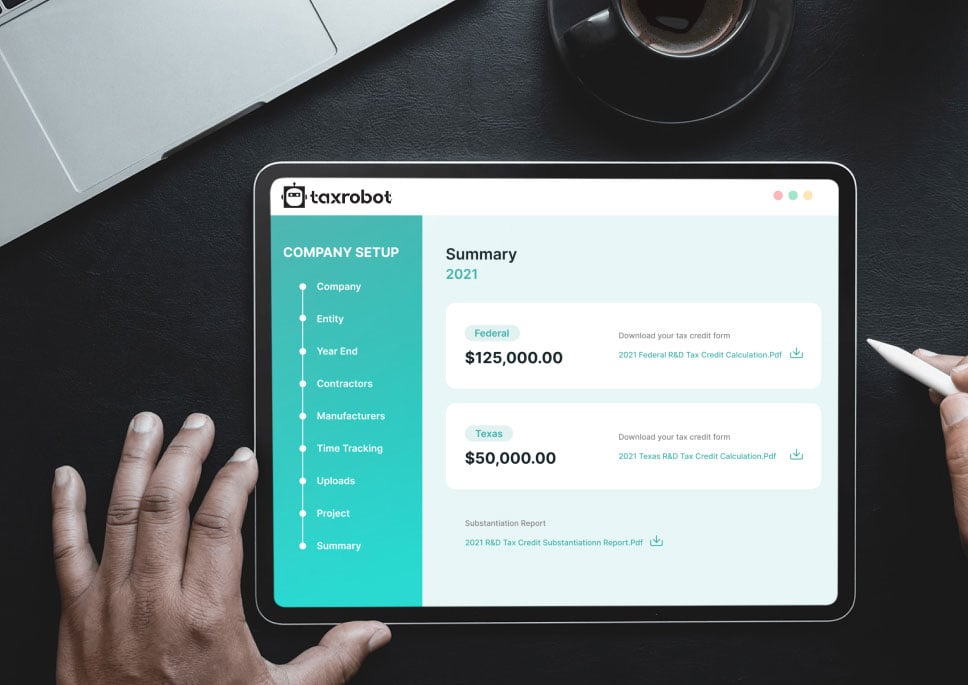

Take a sneak peak

- Limited Time Offer

- Simple Onboarding

- Easy to Use

R&D Tax Credits FAQs

Yes. To qualify for the credit, businesses need to fulfill the tax credit criteria. These include hiring technical and scientific employees, maintaining research activity records, and conducting a certain amount of qualifying research.

The R&D credit calculation is based on a company’s qualified research expenses in the current taxable year. These expenses include wages, supplies, and contract research. Businesses can also use the “regular C corporation calculation” to claim their tax credits. This calculation involves using a four-part formula to determine the amount of eligible expenses for each project.

The R&D Tax Credit has been permanently extended since 2015. This means that businesses can take advantage of the credit each year without having to worry about any potential expiration or changes in eligibility requirements.

What our customers have to say

I highly recommend TaxRobot to anyone considering an R&D Tax Credit software to complete their analysis.

We decided to switch to TaxRobot… Best decision we’ve ever made. More affordable, and less complicated.

I couldn’t believe how easy it was! In under an hour, we saved enough money to hire a new employee.