Rhode Island R&D Tax Credit

Are you tired of navigating the maze that is Research and Development (R&D) tax credits? Do you feel frustrated by missed opportunities and the complexity of understanding R&D tax credit guidelines?

Welcome to TaxRobot, where we turn these frustrations into triumphs. Our innovative AI-powered software is designed to simplify the R&D tax credit claim process, ensuring accuracy, efficiency, and maximum returns for businesses throughout Wisconsin.

Maximize your State Credits today!

Put the R&D tax credit process on autopilot.

Trusted By:

Rhode Island R&D Tax Credits

Discover your eligibility for Rhode Island R&D tax credits and supercharge your enterprise.

Harness the Power of AI with TaxRobot's R&D Tax Software in Rhode Island

At TaxRobot, we leverage innovative artificial intelligence to streamline the often complex and time-consuming process of claiming R&D tax credits. Our software navigates the intricate landscape of R&D tax credits in three straightforward steps:

- Input Your Information: Provide relevant details about your business and its R&D activities.

- Connect Your Systems: Seamlessly integrate TaxRobot with your existing accounting and payroll systems. Our advanced AI technology will meticulously identify qualifying activities and expenditures, aligning them with the latest IRS guidelines.

- Claim Your Credits: TaxRobot accurately calculates your potential R&D tax credit, generating a comprehensive report that is ready for submission to the IRS.

With TaxRobot, you can effortlessly maximize your R&D tax credits and enjoy the benefits without any hassle!

Understanding the Importance of R&D Tax Credit

The R&D tax credit is a government incentive aiming to promote innovation and stimulate progress in different sectors. It offers benefits to companies that increase their investments in research and development within the United States.

For businesses in Rhode Island that are involved in qualifying research activities, these credits can substantially decrease tax obligations and improve cash flow.

Reach Out to Tax Robot’s R&D Tax Credit Experts in Rhode Island

Looking for personalized assistance? Our experienced team of tax professionals are ready to assist you at every stage. Our state-of-the-art software for R&D tax credits makes managing your claims a breeze like never before.

We acknowledge the individuality of each business and believe in providing guidance. That’s why our software not automates the process but also offers expert support, ensuring that you maximize the benefits from your R&D tax credits.

Don’t Face R&D Credits Alone

Don’t face the complexities of R&D tax credits alone. Get in touch with TaxRobot now. Allow our team of gurus to assist you in optimizing your R&D tax credits. Prepare yourself to elevate your business to levels!

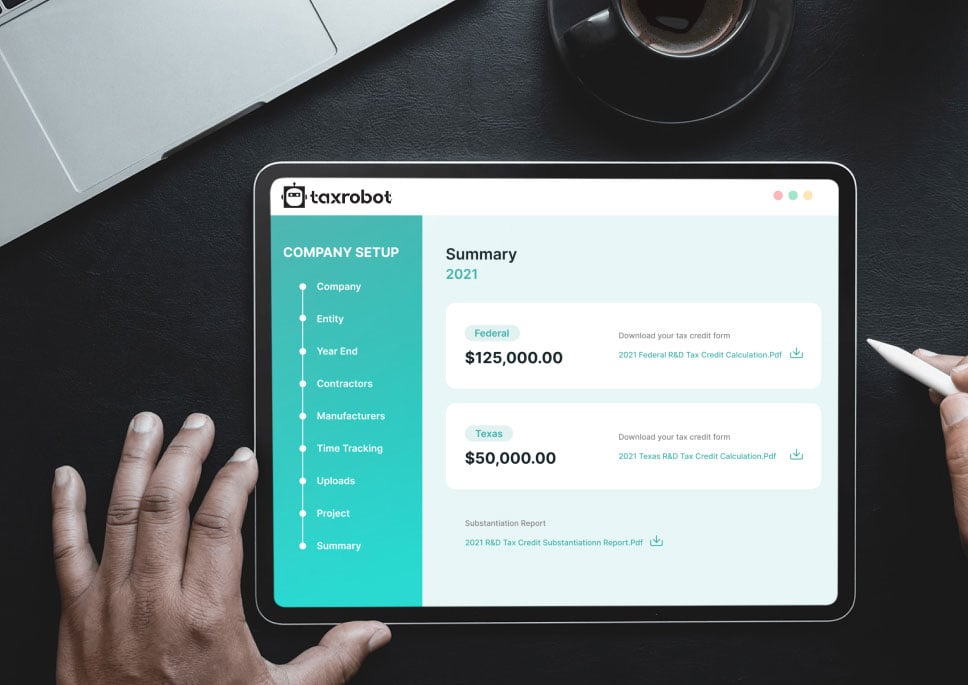

Take a sneak peak

- Limited Time Offer

- Simple Onboarding

- Easy to Use

R&D Tax Credits FAQs

Certainly, there are limitations associated with the R&D Tax Credit. For instance, businesses can only claim a maximum of $250,000 in qualifying expenses within a year. Moreover, it is essential for businesses to have a research and development program and maintain records of the incurred expenses before qualifying. Should you require details regarding the restrictions and prerequisites please don't hesitate to reach out to our team for guidance.

The R&D Tax Credit proves to be a mechanism for businesses aiming to lower their income tax liabilities. It grants businesses the ability to deduct a portion of their research and development expenses, including labor costs, materials, and equipment. By leveraging the benefits of the R&D Tax Credit, businesses can effectively reduce their tax burdens and enhance their cash flow.

If you find yourself unable to utilize the R&D Tax Credit in a given year, you have the option to carry it forward to the year. It's important to note that there is a limit on the duration for which you can carry it forward, and eventually, any unused credits will expire.

You have a window of opportunity of up to two years to claim R&D Tax Credits. Don't miss out on maximizing your claim. Make sure to include all qualifying expenditures incurred during the financial period you're claiming for before the two-year period elapses.

What our customers have to say

I highly recommend TaxRobot to anyone considering an R&D Tax Credit software to complete their analysis.

We decided to switch to TaxRobot… Best decision we’ve ever made. More affordable, and less complicated.

I couldn’t believe how easy it was! In under an hour, we saved enough money to hire a new employee.