Virginia R&D Credit

Research shouldn’t be so expensive! American businesses spent $667 billion on research and development (R&D) in 2019 alone. Some Virginia businesses spent more than $5 million on R&D, putting themselves in the hole long before debuting their products.

That’s why the Virginia R&D credit is so important. You may be able to trim your taxes by tens of thousands of dollars, helping you make money off of your software, products, and patents months sooner. Here’s your essential Virginia R&D credit guide.

Maximize your State Credits today!

Put the R&D tax credit process on autopilot.

Trusted By:

Virginia R&D Credit

Discover your eligibility for Virginia R&D tax credits and supercharge your enterprise.

The Virginia R&D Tax Credit

You qualify for Virginia’s R&D credit when your business spends more than $5 million on research and product development expenses during the tax year. The credit equals 10% of the difference between your current-year R&D expenses and 50% of the average amount of your R&D expenses over the previous three years.

All expenses under IRS Code Section 41 count except for any expenses related to embryonic stem cells or tissues from induced abortions. You can claim your credit against an individual income tax, your corporation’s income tax, or a bank franchise tax.

Virginia caps major research and development credits at $24 million a year; if the amount of applications exceeds the cap, the state will prorate the credit. You cannot claim a credit larger than 75% of the total taxes you owe. However, you can carry forward unused R&D credits for ten years, covering research and development operations in future projects.

You must submit Form MRD to apply for the credit. All applications are due on September 1 of the year immediately after the year your business or sole proprietorship incurred its expenses. You can file for federal and state credits simultaneously and receive them for the same research activities.

Virginia R&D Tax Credit Example

A business in Virginia spends $5.5 million on qualifying R&D operations during 2023. The business spent an average of $4.5 million on qualifying expenses between 2020 and 2022. 50% of $4.5 million is $2.25 million. The difference between the business’s R&D operations in 2023 and $2.25 is $3.25 million. 10% of this amount is $325,000, which is the credit this company would be able to claim.

Refundable R&D Expenses Tax Credit

Virginia is offering a refundable R&D tax credit until January 1, 2025. You can apply for this credit if you incur less than $5 million in expenses. You can receive a maximum of $45,000 for each taxable year, though colleges and universities can receive $60,000. All expenses under IRS Code Section 41 qualify.

You can claim a tax credit equal to 15% of the first $300,000 in your qualified expenses or 10% of the difference between your expenses and 50% of the average expenses from the last three years. Your business cannot claim additional credits if you spend more money. You must fill out Form RDC to receive any credit.

How to Claim Your Tax Credits

You can fill out Form MRD online. Virginia has a spreadsheet you can use to calculate your expenses and determine your tax credit, but you’re not required to use it. You must attach adequate documentation that backs your claim and clearly describes your R&D expenses. Business records, such as payroll forms, are usually convincing, and you can file a testimony from your accountant attesting to the accuracy of your records.

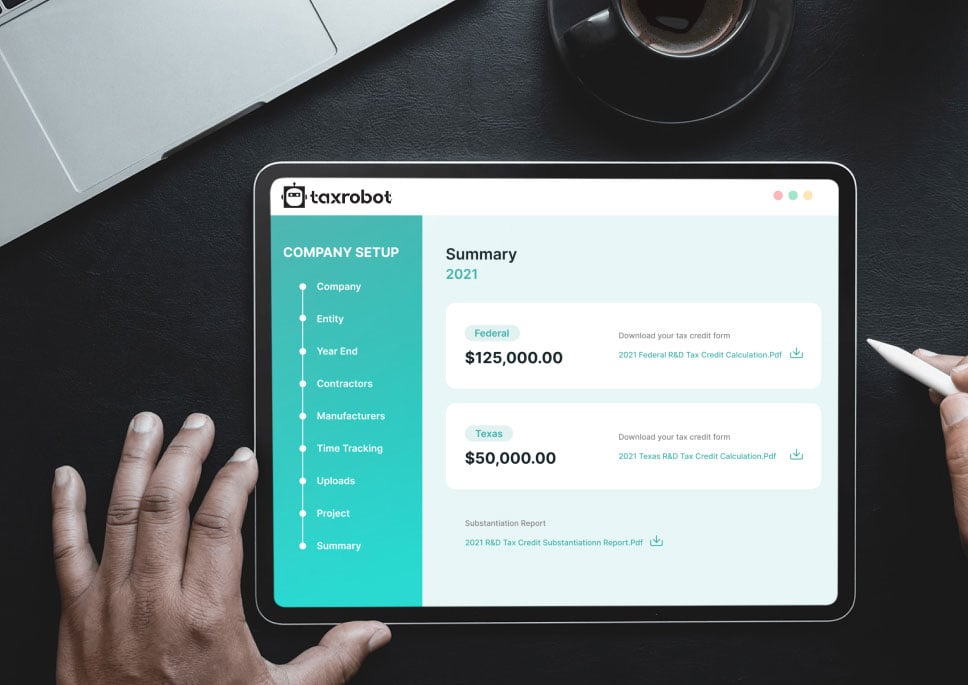

Before you fill out either tax form, you should connect with R&D tax professionals. They can tell you how much money you should claim, collect your documents, and speed up your small business tax planning. You can also download R&D tax software to organize your research and development forms and calculate your return.

Take a sneak peak

- Limited Time Offer

- Simple Onboarding

- Easy to Use

R&D Tax Credits FAQs

The four-part test as outlined in the Internal Revenue Code is used to determine qualified R&D activity.

The Four-Part Test

1). New Or Improved Business Component

Creation of a new product, process, formula, invention, software, or technique; or improving the performance, functionality, quality, or reliability of existing business component.

- Construction of new buildings or renovation of existing buildings

- Invention of a software application

- Manufacturing of a new product or the improvement of the production process for an existing product

- Creation of design documentation

2). Technological In Nature

The activity fundamentally relies on principles of the physical or biological sciences, engineering, or computer science. A taxpayer does not need to obtain information that exceeds, expands or refines the common knowledge of skilled professionals in a particular field.

- Physics (relationship between mass, density and volume; loading as the

result of gravitational attraction) - Engineering (mechanical, electrical, civil, chemical)

- Computer science (theory of computation and design of computational systems)

3). Elimination Of Uncertainty

Uncertainty exists if the information available to the taxpayer does not establish the capability or method for developing or improving the business component, or the appropriate design of the business component.

- The capability of a manufacturer to create a part within the specified tolerances

- The appropriate method of overcoming unsuitable soil conditions during construction

- The appropriate software design to meet quality and volatility requirements

4). Process Of Experimentation

A process designed to evaluate one or more alternatives to achieve a result where the capability or method of achieving that result, or the appropriate design of that result, is uncertain as of the beginning of the taxpayer’s research activities.

- Systematic process of trial and error

- Evaluating alternative means and methods

- Computer modeling or simulation Prototyping Testing

The R&D tax credit is one of the most misunderstood tax incentives available. Considering the myriad of industries and activities that legally qualify for the credit, the term “research and development” is a misnomer. Additionally, the R&D tax credit requires specialized knowledge and technology to identify and calculate the incentive properly.

Companies of various industries are unaware that they are eligible to claim the R&D tax credit. Under the Internal Revenue Code’s definition of R&D, many common activities qualify. You can get tax benefits for industries including software, technology, architecture, engineering, construction, manufacturing, and more.

The R&D tax credit can be claimed for all open tax years. Generally, open tax years include the prior three tax years due to the statute of limitations period. In certain circumstances, the law allows businesses to claim the R&D tax credit for an extended period of time. It is common for companies to amend previous tax years to claim this benefit and reduce the maximum amount of tax liability.

Partnerships and S corporations must file this form to claim the credit. The credit will flow from the Form 6765, to the Schedule K-1, to the Form 3800 on the individual’s tax return. For individuals receiving this credit that have ownership interest in a partnership or S corporation, Form 6765 is not required on the individual return.

Individuals claiming this credit can report the credit directly on Form 3800, General Business Credit if their only source for the credit is a partnership, S corporation, estate, or trust. Otherwise, Form 6765 must be filed with the individual’s tax return (e.g. sole proprietorship).

For tax years prior to 2016, the credit can be used to reduce the taxpayer’s regular tax liability down to the tentative minimum tax. The credit cannot be used to offset alternative minimum tax. Beginning in tax year 2016, eligible small businesses have expanded utilization for the credit. For these eligible small businesses, the regular tax liability can offset alternative minimum tax using the “25/25” rule.

What our customers have to say

I highly recommend TaxRobot to anyone considering an R&D Tax Credit software to complete their analysis.

We decided to switch to TaxRobot… Best decision we’ve ever made. More affordable, and less complicated.

I couldn’t believe how easy it was! In under an hour, we saved enough money to hire a new employee.