Washington R&D Credit

Take credit for your work! The research and development tax credit (R&D credit) reduces your taxes dollar for dollar for your design and development processes.

The federal government and many state governments have R&D credits. If you can apply for both, you can save thousands of dollars on your business tax bill. Here’s what you need to know about the Washington R&D credit and how to apply for it.

Maximize your State Credits today!

Put the R&D tax credit process on autopilot.

Trusted By:

Washington R&D Credit

Discover your eligibility for Washington R&D tax credits and supercharge your enterprise.

The Basics of the R&D Credit

Section 41 of the Internal Revenue Code provides the details for the federal R&D credit. Nearly all research activities and products qualify for the credit. You can claim money for making products, developing formulas, and creating software. You can claim up to 20% of the money you use to pay your research employees. However, you cannot claim money for research after you make products or market surveys and studies.

You can claim the R&D credit by filing IRS Form 6765. You must have documents proving that your expenses meet the requirements under Section 41. You can use your business’s financial records and testimony from company employees to back your claim.

The Protecting Americans from Tax Hikes Act of 2015 made the R&D credit permanent and expanded the credit to small businesses. You can apply for the credit regardless of how much you make or what your gross receipts are. You can carry your credit forward for up to 20 years, covering expenses you will pay in the future. Businesses can also claim credits from research costs incurred during the previous three tax years.

Does Washington Have an R&D Credit?

Unlike most states, Washington does not have its own R&D credit. The credit expired in 2014, and there are no plans to renew it. However, some county governments offer manufacturing, research, and development tax deferrals. Qualifying companies must construct buildings within the county after receiving tax referral certificates, and they can claim up to $400,000 for each relevant employee.

You can qualify for other tax incentive programs, depending on your industry, research operations, and size. Washington offers credits for manufacturers of commercial airplanes that incur expenses during the research and design process.

What to Do

Before you file your federal and state tax returns, you should talk to your accountant and get full information and balance sheets about your company’s research and development operations. Collect your paperwork so you can calculate how much you spend and corroborate your claim for a credit.

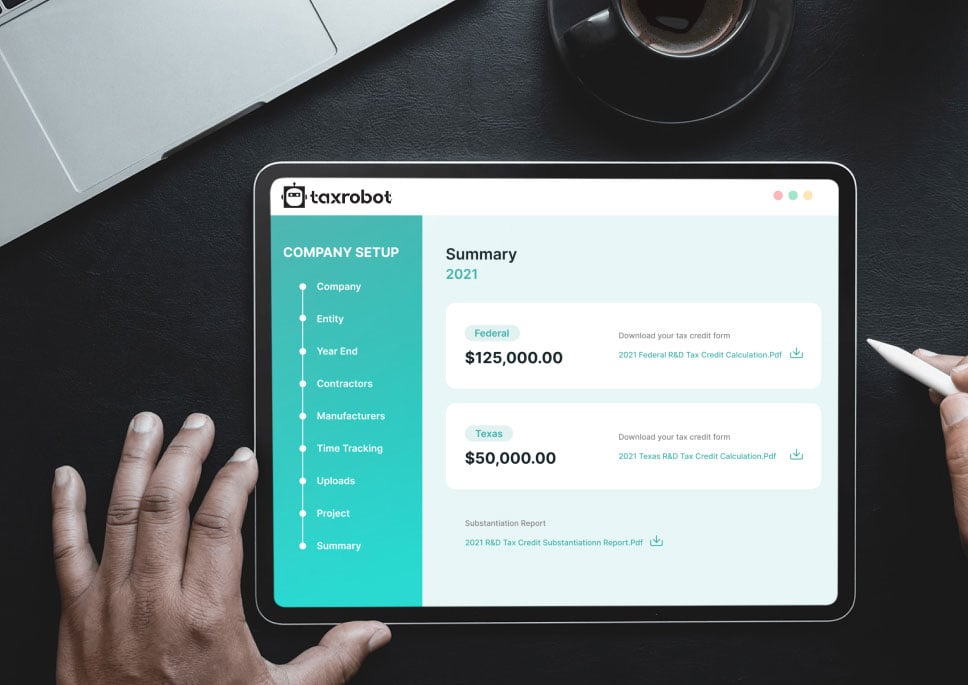

Artificial intelligence and software can simplify the process of filing tax credits. Download a tool to sort through your documents, calculate your return, and file a claim. AI tools that can respond to audits are extremely helpful, so look for software with automatic audit tracking.

If you’re applying for a countywide tax credit, you must submit your forms to the county government. Not all county governments have the same rules for their credits, so if you’re applying for ones in several counties, you need to meet with the county tax assessors so you know what to do.

While completing research and development, keep track of your expenses using spreadsheets and maintain your receipts and payroll forms. Create an organization system that lets you easily access and digitize your most important documents. You can find payroll software to keep your payroll forms organized and file your payroll tax forms sooner.

Take a sneak peak

- Limited Time Offer

- Simple Onboarding

- Easy to Use

R&D Tax Credits FAQs

The four-part test as outlined in the Internal Revenue Code is used to determine qualified R&D activity.

The Four-Part Test

1). New Or Improved Business Component

Creation of a new product, process, formula, invention, software, or technique; or improving the performance, functionality, quality, or reliability of existing business component.

- Construction of new buildings or renovation of existing buildings

- Invention of a software application

- Manufacturing of a new product or the improvement of the production process for an existing product

- Creation of design documentation

2). Technological In Nature

The activity fundamentally relies on principles of the physical or biological sciences, engineering, or computer science. A taxpayer does not need to obtain information that exceeds, expands or refines the common knowledge of skilled professionals in a particular field.

- Physics (relationship between mass, density and volume; loading as the

result of gravitational attraction) - Engineering (mechanical, electrical, civil, chemical)

- Computer science (theory of computation and design of computational systems)

3). Elimination Of Uncertainty

Uncertainty exists if the information available to the taxpayer does not establish the capability or method for developing or improving the business component, or the appropriate design of the business component.

- The capability of a manufacturer to create a part within the specified tolerances

- The appropriate method of overcoming unsuitable soil conditions during construction

- The appropriate software design to meet quality and volatility requirements

4). Process Of Experimentation

A process designed to evaluate one or more alternatives to achieve a result where the capability or method of achieving that result, or the appropriate design of that result, is uncertain as of the beginning of the taxpayer’s research activities.

- Systematic process of trial and error

- Evaluating alternative means and methods

- Computer modeling or simulation Prototyping Testing

The R&D tax credit is one of the most misunderstood tax incentives available. Considering the myriad of industries and activities that legally qualify for the credit, the term “research and development” is a misnomer. Additionally, the R&D tax credit requires specialized knowledge and technology to identify and calculate the incentive properly.

Companies of various industries are unaware that they are eligible to claim the R&D tax credit. Under the Internal Revenue Code’s definition of R&D, many common activities qualify. You can get tax benefits for industries including software, technology, architecture, engineering, construction, manufacturing, and more.

The R&D tax credit can be claimed for all open tax years. Generally, open tax years include the prior three tax years due to the statute of limitations period. In certain circumstances, the law allows businesses to claim the R&D tax credit for an extended period of time. It is common for companies to amend previous tax years to claim this benefit and reduce the maximum amount of tax liability.

Partnerships and S corporations must file this form to claim the credit. The credit will flow from the Form 6765, to the Schedule K-1, to the Form 3800 on the individual’s tax return. For individuals receiving this credit that have ownership interest in a partnership or S corporation, Form 6765 is not required on the individual return.

Individuals claiming this credit can report the credit directly on Form 3800, General Business Credit if their only source for the credit is a partnership, S corporation, estate, or trust. Otherwise, Form 6765 must be filed with the individual’s tax return (e.g. sole proprietorship).

For tax years prior to 2016, the credit can be used to reduce the taxpayer’s regular tax liability down to the tentative minimum tax. The credit cannot be used to offset alternative minimum tax. Beginning in tax year 2016, eligible small businesses have expanded utilization for the credit. For these eligible small businesses, the regular tax liability can offset alternative minimum tax using the “25/25” rule.

What our customers have to say

I highly recommend TaxRobot to anyone considering an R&D Tax Credit software to complete their analysis.

We decided to switch to TaxRobot… Best decision we’ve ever made. More affordable, and less complicated.

I couldn’t believe how easy it was! In under an hour, we saved enough money to hire a new employee.