Wisconsin R&D Tax Credit

Are you tired of navigating the maze that is Research and Development (R&D) tax credits? Do you feel frustrated by missed opportunities and the complexity of understanding R&D tax credit guidelines?

Welcome to TaxRobot, where we turn these frustrations into triumphs. Our innovative AI-powered software is designed to simplify the R&D tax credit claim process, ensuring accuracy, efficiency, and maximum returns for businesses throughout Wisconsin.

Maximize your State Credits today!

Put the R&D tax credit process on autopilot.

Trusted By:

Wisconsin R&D Tax Credits

Discover your eligibility for Wisconsin R&D tax credits and supercharge your enterprise.

The Frustrations of Missing Out on R&D Tax Credits

Missing out on R&D tax credits can be a significant setback for businesses. It’s not just about the immediate financial loss. It’s also about the missed opportunities for investment in further innovation and growth.

Many businesses in Wisconsin, from startups to established corporations, often overlook these credits due to the complexity involved in identifying qualifying activities and calculating the credits.

The Complexity of Understanding R&D Tax Credits

To fully comprehend the R&D tax credit, one must possess an understanding of tax regulations and guidelines set by the IRS. Determining what qualifies as R&D can often be vague. The procedure for claiming these credits can be both burdensome and time intensive.

The intricacy involved in this process often discourages businesses from taking advantage of the R&D tax credits they are entitled to, resulting in setbacks.

Harness the Power of AI with TaxRobot’s R&D Tax Software

TaxRobot is here to change the game. Leveraging the power of artificial intelligence, our software simplifies the entire R&D tax credit process. It seamlessly integrates with your accounting and payroll systems, carefully identifying activities and expenses based on the most up-to-date IRS guidelines.

Here’s how it works:

- Input Your Business Information

- Connect Your Systems to Calculate Qualifying Activities and Expenditures

- Claim Your Credits

With TaxRobot, you no longer need to worry about understanding every nuance of R&D tax credits or fear missing out on credits due to complexity. Our software does all the hard work for you, ensuring you receive the maximum possible refund. Contact us today for a free estimate.

Stay Ahead with TaxRobot in Wisconsin

As the state continues to innovate, the opportunities for claiming R&D tax credits are increasing. TaxRobot stays updated with these changes, ensuring your business doesn’t miss out on any potential credits.

Begin Your Journey with TaxRobot Today

Say goodbye to the frustrations and complexities of R&D tax credits. With TaxRobot, you have a reliable partner dedicated to maximizing your R&D tax credits while providing excellent customer service.

Experience the future of R&D tax credits today. Contact us at TaxRobot and let our AI-driven software and team of experts guide you through the process.

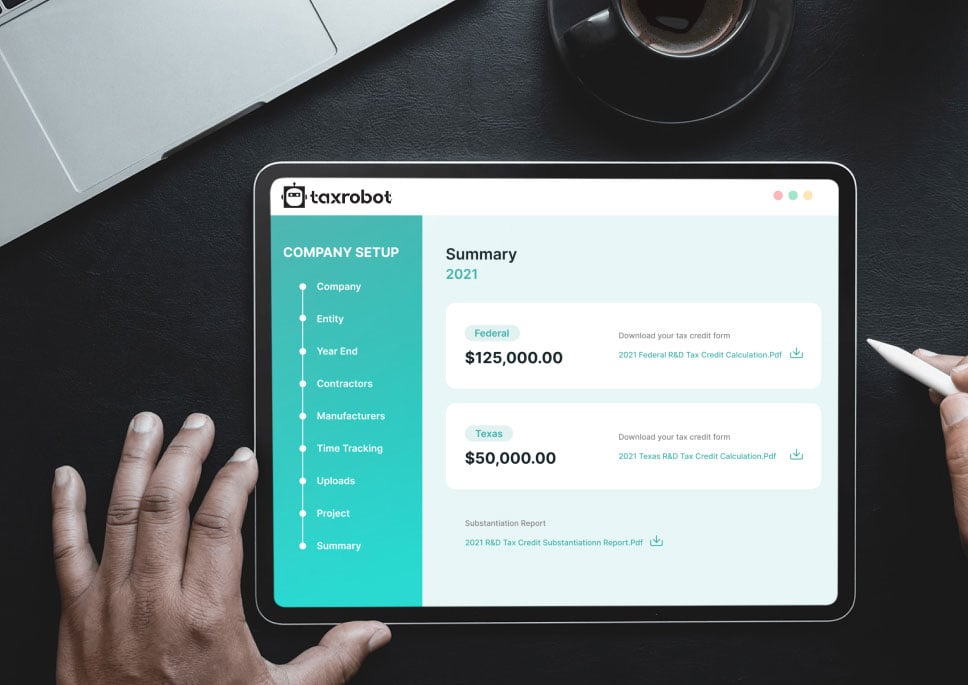

Take a sneak peak

- Limited Time Offer

- Simple Onboarding

- Easy to Use

R&D Tax Credits FAQs

Wondering which activities don't qualify for R&D Tax Credits? Well, arts, social sciences, or humanities research won't make the cut. Additionally, any research conducted outside the U.S., or its territories is also ineligible. Keep these exclusions in mind when exploring the possibilities!

The R&D tax credit offers chances for startup businesses to lower their tax liability and keep cash in their business with the federal payroll tax offset. Check out how here!

The Research and Development (R&D) Tax Credit is a federal incentive that allows businesses to claim credit for their expenditures related to innovation and development. Think expenses on employee wages, research materials, and subcontractor costs! Through this program, companies can receive refunds of up to 6.5% of their research-related expenditures.

Qualifying expenses like wages, supplies, and contract research costs can be claimed for the credit. Companies can also claim expenses related to software development and prototyping as long as they are used in a qualified activity. Additionally, activities like researching new products, improving existing ones, and developing prototypes all fall under the tax credit umbrella.

What our customers have to say

I highly recommend TaxRobot to anyone considering an R&D Tax Credit software to complete their analysis.

We decided to switch to TaxRobot… Best decision we’ve ever made. More affordable, and less complicated.

I couldn’t believe how easy it was! In under an hour, we saved enough money to hire a new employee.