Many aspects go into running a business. Bookkeeping is a crucial business component, as it can impact your business’s growth and success.

Bookkeeping encompasses various tasks, including data entry, filing taxes, and more. Where do you get started?

Read this guide from Tax Robot to learn how to start bookkeeping for your business.

Related: Startup Stages: A Guide to Every Step of the Process

Table of Contents

Choose Your Bookkeeping Software

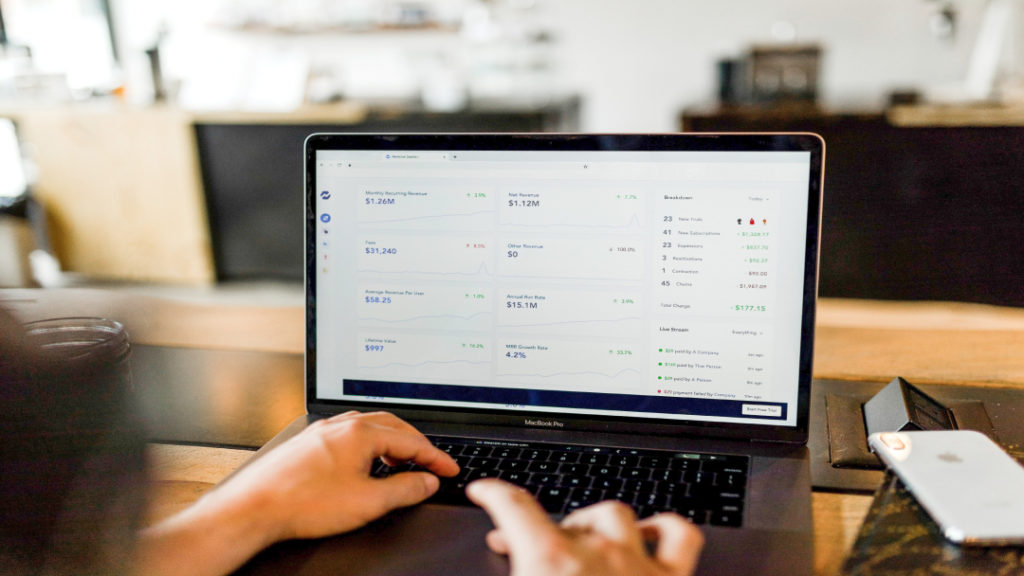

Choosing the right bookkeeping software is the first thing you need to do when setting up shop. There are many bookkeeping software programs to choose from, so it’s vital to do your research before deciding.

When choosing software, costs, usability, and features are the main things to consider. If your business plans to take advantage of the R&D tax credit, choose software to help you automate this process.

Once you’ve chosen the right software, you need to take time to set it up. This often involves connecting business bank accounts, reconciling transactions, and taking care of any necessary data entry. You should also study the software to learn about all the processes you can streamline.

Related: How R&D Credits Help with Payroll Taxes

Choose Your Entry System

Next, you’ll need to choose between a single or double-entry accounting system. Single-entry accounting records all your business transactions at once, either as an income or an expense.

This method is best for small businesses that don’t have significant equipment or inventory involved in their finances, as it’s straightforward. On the other hand, a double-entry accounting system enters each transaction twice, as both credit and debit, to balance the books between your accounts.

While double-entry accounting is a bit more complicated, it can help you prevent errors when recording transactions. Take time to choose your entry system, as it will impact how you manage your finances.

Choose Your Accounting Method

Choosing your accounting method is the next important step in setting up your bookkeeping. Cash-based or accrual-based accounting are the two methods to choose from.

Cash-based accounting allows you to record transactions when money switches hands. However, the method doesn’t record your company’s outstanding bills or invoices until you’ve paid your bills.

On the other hand, accrual-based accounting will record invoices and bills even if your funds haven’t been exchanged. Most financial experts recommend accrual-based accounting, but ultimately, the decision is up to you.

Set Up Payroll and Coordinate with a Tax Specialist

You have the option to process payroll within your accounting software or to purchase separate payroll software.

How you set up and manage your payroll will depend on the type of software you choose. You’ll also want to work with a tax specialist to identify potential tax deductions available to your business. A tax specialist can also help you make your tax procedures as seamless as possible.

Remember to Record Every Financial Transaction

While bookkeeping can help you automate some of your financial processes, you still need to remember to record every transaction.

In addition to having your financial data on hand, you’ll need to determine which accounts will be credited and which will be debited. It’s crucial to correctly record each credit and debit transaction. Otherwise, your account balances won’t match, and you won’t have an accurate picture of your finances.

Most bookkeeping software automatically imports your business bank data, so you don’t need to manually input and organize each transaction. However, if you’re using spreadsheet software, you’ll need to enter this information manually.

Click here to learn about the best funding sources for startups!

Balance Your Books and Prepare Financial Reports

It’s crucial to balance your books to ensure your credit and debit account match. Most businesses will do this at the end of the day, week, month, or quarter. The totals should always match, as it means your books are balanced.

Once you’ve balanced your books, it’s time to prepare your financial reports. This encompasses taking a closer look at what the transactions in your books mean. Summarizing the cash flow in your accounts will give you a better picture of your company’s financial health.

You’ll then use this information to decide your business’s future. Here are some financial reports you’ll want to create using information from your bookkeeping:

- Balance sheet: A balance sheet summarizes your company’s assets, equity, and liabilities in a single time period. Your total assets should equal your total equity and liabilities. The balance sheet will give you a peek into the current health of your business.

- Profit and loss statement: This statement (also known as an income statement) breaks down your business costs, revenue, and expenses over a set time period. This will help you forecast your sales and expenses to make better forecasts.

- Cash flow statement: This statement helps you understand where your business spends and earns money, and it also helps you know your ability to pay upcoming bills.

Your bookkeeping software will help you prepare these financial reports, often in real time. This is crucial for business owners who need to make fast financial decisions based on the immediate health of their business.

Related: 5 Best Startup Business Tips You Need to Know

Time to Start Bookkeeping

It’s now time to set up bookkeeping for your small business. As you can see, bookkeeping software can help you with many of your financial tasks.

Click here to learn about Tax Robot’s bookkeeping software that can help you with your R&D tax credits!