Did you know that the total global debt of non-financial corporations has reached a staggering $87 trillion? However, debt (and any other company’s financial obligations) are okay. The reality is that these liabilities are an essential part of running a business.

But precisely what are liabilities in accounting? Understanding this question is integral to keeping track of your financial obligations. That’s why we made this guide breaking the concept down for you. Let’s get started!

Table of Contents

What Are Liabilities?

You can think of liabilities as your company’s financial obligations to other businesses or financial institutions. Liabilities include things links debt that your company owes in the form of loans, bills, and mortgages.

However, it can also be in the form of obligations like past events, sales, business transactions, or exchange of services. Liabilities aren’t necessarily a bad thing. They’re a vital part of daily business operations. They allow companies to create value and engage in new business.

That being said, if a company’s liabilities aren’t correctly managed, it can lead to poor financial performance. This is up there with one of the most common mistakes new small businesses make. If things get bad enough, it can eventually result in bankruptcy.

Why Do You Need to Keep Track of Liabilities in Accounting?

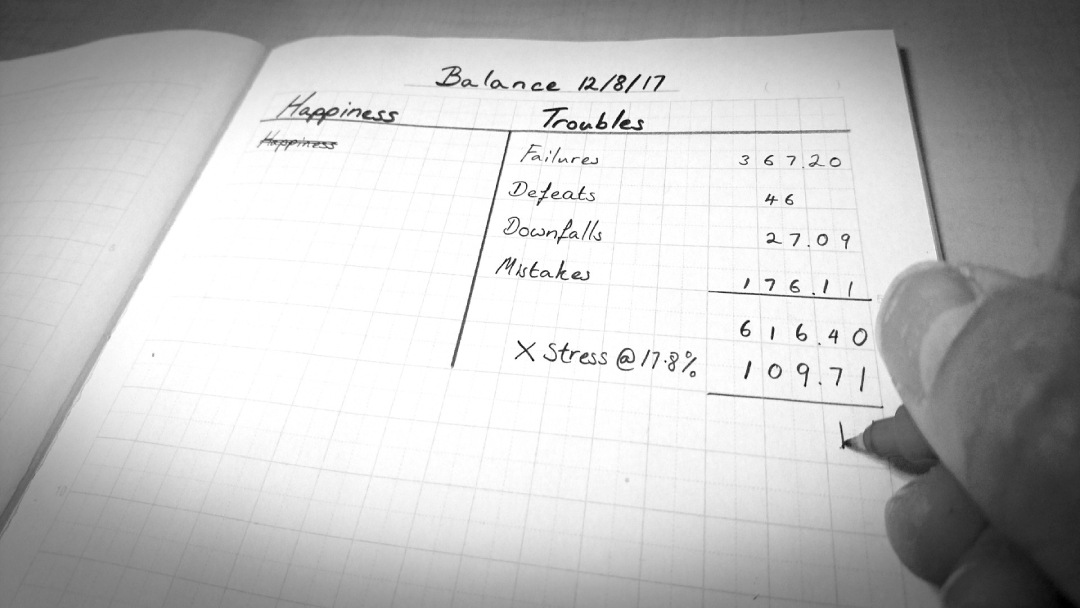

Liabilities are essential in accounting because a business is required to keep an accurate record of all of its liabilities on its balance sheet. Specifically, the liabilities need to be reported by following accepted accounting procedures.

Most international countries use the accounting standards presented by the International Financial Reporting Standards (IFRS). However, if you live in the United States, you must follow the GAAP (or Generally Accepted Accounting Principles) for reporting.

The simple equation for finding your liabilities is subtracting your assets from your equity. Within your balance sheet, you should also include the date when the liabilities are due.

Need help keeping track of your liabilities in accounting? TaxRobot has over fifteen years of tax consulting experience, which we can use to help you minimize your liabilities.

What Are the Types of Liabilities?

Not all liabilities fit neatly into one category. Generally speaking, you can divide liabilities into three main divisions: current, non-current, and contingent. In this section, we’ll discuss each of them in more detail.

Related: 10 Best Business Funding Sources for 2023

Current Liabilities

The primary way that liabilities are classified is through when they’re due. So current liabilities are financial obligations that are due within the next year.

Most current liabilities fall under regular business operation expenses. Some of the current liabilities you’re likely to encounter include things like:

- Wages payable: The total income your employees have earned but that still needs to be paid.

- Interest payable: Interest expenses that a company needs to pay on credit they’ve taken out.

- Income taxes payable: The amount of money that you owe to the government in taxes before incentives.

- Dividends payable: After a dividend is declared, this is the amount you owe to shareholders.

- Bank account overdrafts: payment when insufficient funds are in your bank account.

- Deferred revenue: Early costs for a service the company hasn’t yet provided.

Non-Current Liabilities

Compared to current liabilities, non-current aren’t due for over a year. Long-term liabilities only include the portion that you need to pay in the short term. Let’s dive into some of the non-current liabilities you’re likely to encounter:

- Bonds payable: The number of outstanding bonds a company uses to finance its long-term operations.

- Mortgage payable: The principal amount borrowed when a company takes out a mortgage.

- Notes payable: The overall value of promissory notes.

- Deferred tax liability: When a company underpays on taxes, this is the amount they’ll need to pay later on, including interest.

Related: IRS Form 944 Instructions and Free PDF Download

Contingent Liabilities

Contingent liabilities are different from current or non-current liabilities in that they’re theoretical. That means that depending on the outcome of an event in the future, it may or may not happen.

An example might be a potential lawsuit that the company is facing. For example, a company expects to lose a lawsuit because of the evidence on the other side.

However, contingent liabilities are only listed if the outcome is likely and an amount owed can be estimated. The legal expenses would be included as a contingent liability.

How Can You Reduce Your Liabilities?

The best way to reduce your liabilities is obviously to pay them off. However, this is only sometimes possible right away. In that case, you should manage each new liability carefully. You want to bite off only what you can swallow regarding liabilities.

You can also reduce your liabilities by taking advantage of credits and deductions when tax season rolls around.

For example, the R&D tax credit can lower the amount of payroll taxes that you own. From there, you can put the money you’ve saved toward liability financial obligations.

R&D tax credits are a great way to reduce some of your liabilities. Check out this page for our software to find out how it can save you money and time with these types of credits.

The Importance of Keeping Track of Your Liabilities

There’s a reason why 50% of businesses fail within the first five years. Most likely didn’t keep a close tally of their various liabilities. When you avoid carefully tracking your liabilities, you’re opening your business up for severe financial decline.

Eventually, it can even lead to bankruptcy. That’s why you should never leave your liabilities up to guesswork. Keep accurate records and take as many steps as possible to reduce your liabilities.

Related: Qualified Research Expenses (QRE): A Complete Guide