Accounting Bookkeeping Checklist for New Clients

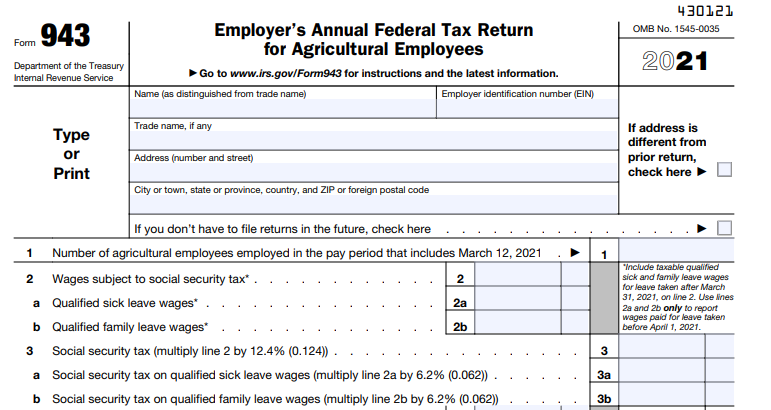

You’ve completed all the steps needed to secure your next accounting client. But once you do this, you need to make sure you complete a few more steps to get them ready. The onboarding stage for accounting clients can be more overwhelming than in other industries. After all, you need to gather documents, ask for …

Accounting Bookkeeping Checklist for New Clients Read More »